Toshiyuki MatsuuraHow Do Japanese Manufacturing Firms React to the Surge of Imports from China?(08/11/2017)

Recently, the surge of the import from China has attracted policy makers’ attention in many developed countries. For example, series of studies by David Autor and his colleagues reveal that rising Chinese import to US has substantial negative impact on local labor market. (Autor et al. 2013)., They demonstrate that 55 percent of the decline in US manufacturing employment from 2000 to 2007 can be explained by rising exposure to imports from China. Furthermore, the exposure to Chinese imports induces a decline in wages, a higher unemployment ratio, and increases in transfer payments through multiple federal and state programs. Some studies present similar evidence for Europe. For example, Malgouyers (2016) finds that France also experienced decline in manufacturing employment due to import competition from China. Furthermore, it polarized the local employment in the manufacturing sector. Similar patterns of the impact of Chinese imports on local employment are found by Balsvik et al. (2015) for Norway, and by Dooso et al. (2014) for Spain.

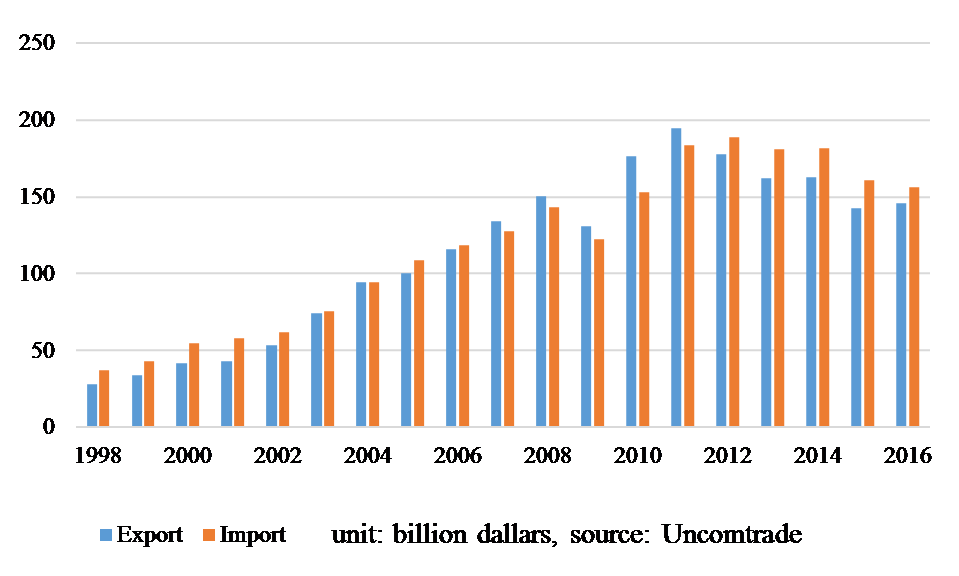

How do rising imports from China affect Japanese manufacturing industries? Is it more significant because of geographical proximity? According to recent studies, the effect of imports from China on local employment in Japan may differ from that in the US or Europe. For example, Tomiura (2003) investigates the impact of the increase in imports from low wage country using Japanese detailed industry-level data and finds a negative impact on the employment in some industries. However, the economic impact is not so large. A more recent study by Taniguchi (2016) examines the impact of rising Chinese imports on the Japanese local labor market following the methodology used in Autor et al. (2013) and finds that the impact of imports from China is not negative; rather, it has positive effect in some cases. Figure 1. Japan’s imports and exports from/to China

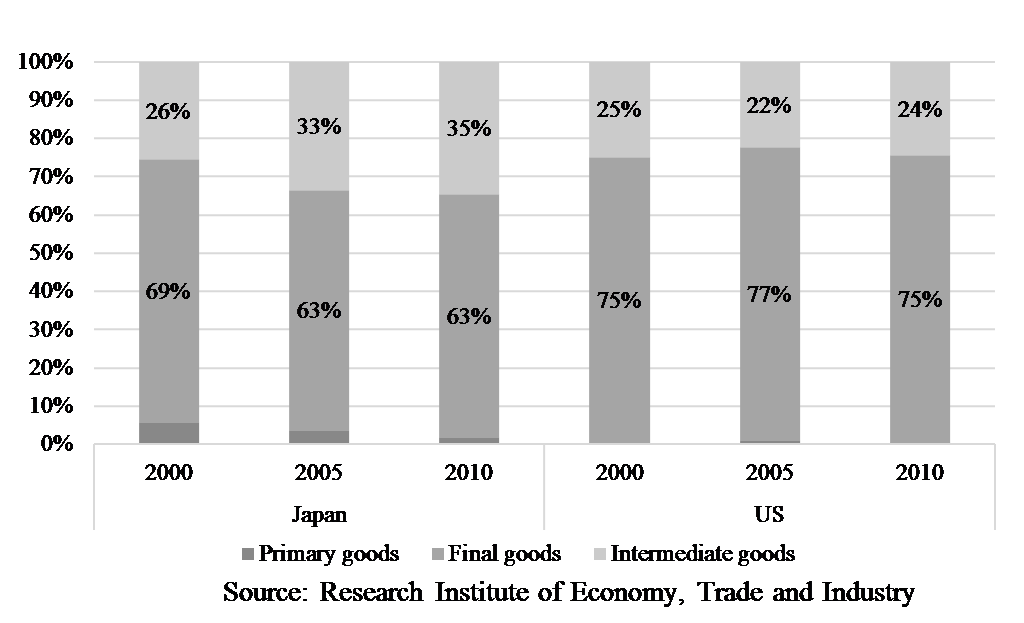

Why do rising imports from China have a different effect in Japan? There are several possible reasons for this finding. First, while US imports from China are five times as large as US exports to China, Japan’s import from China are almost comparable to Japan’s export to China. Figure 1 presents Japan’s export and import from/to China from 1998 to 2016. Both exports and imports have increased significantly in the 2000s. Although Japan’s imports from China exceed exports to China, the exports amount to 93% of the imports. It implies that the negative impact of import competition might be mitigated by the increase in exports. Second, the share of intermediate goods in China’s exports to Japan is larger than that in China’s exports to the US. Figure 2 shows the share of final goods and intermediate goods in import from China to US or Japan. While the share of final goods and intermediate goods in imports from China to Japan is 63% and 35% respectively, those to the US is 75% and 24% respectively. Most intermediate goods imports from China are considered as foreign outsourcing by Japanese firms or intrafirm trade between Japanese parent firms and their affiliates in China. Previous studies, such as Hijzen et al. (2010) or Görg et al. (2006) suggest that foreign outsourcing may contribute to productivity improvements. As for intrafirm trade, my colleagues and myself (Hayakawa et al., 2015) investigate the impact of firm’s FDI on the productivity growth rate at home countries and find that firms engaged in intra-firm international division of labor have substantially improved their productivity in the home country. This result is more significant for those firms investing in East Asian countries. Actually, Taniguchi (2016), who examines the impact of rising imports from China to Japan on local labor markets, argues that the positive effect is more significant when focusing on the import of intermediate goods from China. Figure 2. The share of type of goods in imports from China

Although the labor market effect of rising Chinese import is not significant, a fierce competition from low wage country forces some firms to switch their products or improve product quality to escape from the competition, or just give up producing existing products. There is anecdotal evidence that Japanese manufacturing firms have restructured their business because of fierce competition against emerging countries like China. For example, one of the major Japanese electric companies, Sanyo Electric Co, Ltd has started to restrict its business in the middle of 2000s. In 2008, Sanyo became a subsidiary of Panasonic Co. Ltd. Panasonic continued to restructure their product lines and finally announced to terminate the Sanyo brand in 2012. To understand the impact of rising imports from low wage countries on Japan, it is indispensable to investigate how Japanese firms react to the import competition. In the research at Fondation France-Japon de l’EHESS, we would like to investigate how Japanese firms react to the surge of imports from developing countries like China. Specifically, we will focus on the product quality upgrading and product switching using comprehensive firm-plant-product level data in Japan. Following Khandelwal et al (2013), we measure the product quality as a residual of demand function. And product switching is defined as adding new products or dropping incumbent products by each firm or plant. In this project, we shed light not only on the capability of firms but also on regional characteristics. Our rich firm-plant-product level data set enables us to explore what kind of firms are more likely to switch their product or improve product quality and whether the external regional factors such as industry agglomeration mitigate the negative impact of rising import from China or not. ReferencesAutor, D., Dorn, D., and Hanson, G., 2013, "The China Syndrome: Local Labor Market Effects of Import Competition in the United States", American Economic Review, 103(6) 2121-2168. Balsvik, R., Jensen, S., and Salvanes, K G., 2015, "Made in China, Sold in Norway: Local Labor Market Effects of an Import Shock", Journal of Public Economics, 127, 137-144. Donoso, V., Martin, V., and Minondo A., 2015, "Do Differences in the Exposure to Chinese Impacts Lead to Differences in Local Labour Market Outcomes? An Analysis for Spanish Provinces", Regional Studies, 49(10), 1746-1764. Görg, H., Hanley, A., and Strobl, E., 2008, "Productivity Effects of International Outsourcing: Evidence from Plant-level Data", Canadian Journal of Economics, 41(2), 670-688. Hayakawa, K., Matsuura, T., and Motohashi, K., 2016, "How Does FDI Affect Productivity at Home?: Evidence from a Plant-level Analysis", Journal of Industry, Competition and Trade, 16(4), 403-422. Hijzen, A., Inui, T., and Todo, Y., 2010, "Does Offshoring Pay? Firm-Level Evidence from Japan", Economic Inquiry, 48(4), 880-895. Khandelwal, A., Schott, P., Wei, Shang-Jin, 2013, "Trade Liberalization and Embedded Institutional Reform: Evidence from Chinese Exporters", American Economic Review, 103(6), 2169-2195. Malgouyers, C., 2016, "The Impact of Chinese Import Competition on Employment and the Wage Distribution: Evidence from French Local Labor Markets", Journal of Regional Science Taniguchi, M., 2016, "The Effect of an Increase in Imports from China on Regional Labor Markets in Japan", mimeo. Tomiura E., 2003, "The impact of import competition on Japanese manufacturing employment", Journal of the Japanese and International Economies, 17(2),pp. 118-133. |

|

Recherche |  |

FFJ Research Statement |  |

Toshiyuki Matsuura |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".