Francis D. Kim

When Family Capitalism Meets

Shareholder Activism: South Korea

(30/08/2017)

Much scholarly attention has been given to the “short-termism” practices of corporate managers and activist investors. Less attention has been given, however, to their interactive dynamics in an economy partly run by a few corporate families, as in South Korea, known particularly for the longevity of chaebols (i.e., the large-scale, family-controlled business groups). As such an economy is the mode around the world (La Porta et al., 1999), there is motivation for a South Korean case study, where the family managers have demonstrated the power to exploit shareholder activism. Nonetheless, the unfolding scandal and my analysis highlight the salient role of activist investors, to act now by calling for transparency in corporate governance.

A Narrative of Economic Entrenchment by Family Ownership

March 2017 was a watershed moment in South Korea, as President Park Guen-hye was impeached and removed from office (The Constitutional Court of Korea, 2017.03.10). The court found that Park had seriously breached the property rights of free enterprises and betrayed public trust in colluding with top corporate families. Prominent in this scandal has been the Samsung Group, whose heir and family manager, Lee Jae-Yong, was ruled guilty by a criminal court -- for bribing a confidante of former President Park (Seoul Central District Court, 2017.08.25). These bribes were paid to obtain government support for the restructuring of Samsung to a holding company, which would strengthen Lee’s family control over Samsung Electronics. The state-run National Pension Service, a major institutional investor in Samsung C&T, illegitimately supported the managerial decision at a proxy fight with activist investor Elliott Management, who opposed the family succession scheme. To assure, Samsung managers had fought in court successfully to resurrect the voting rights of repurchased shares from its previous buybacks as they re-sold them to a third-party white knight on the eve of the fight. The court noted that Samsung reduced its restructuring cost after a private meeting with a person-in-charge from Korea’s Fair Trade Commission.

Policy Context: The Holding Company Act

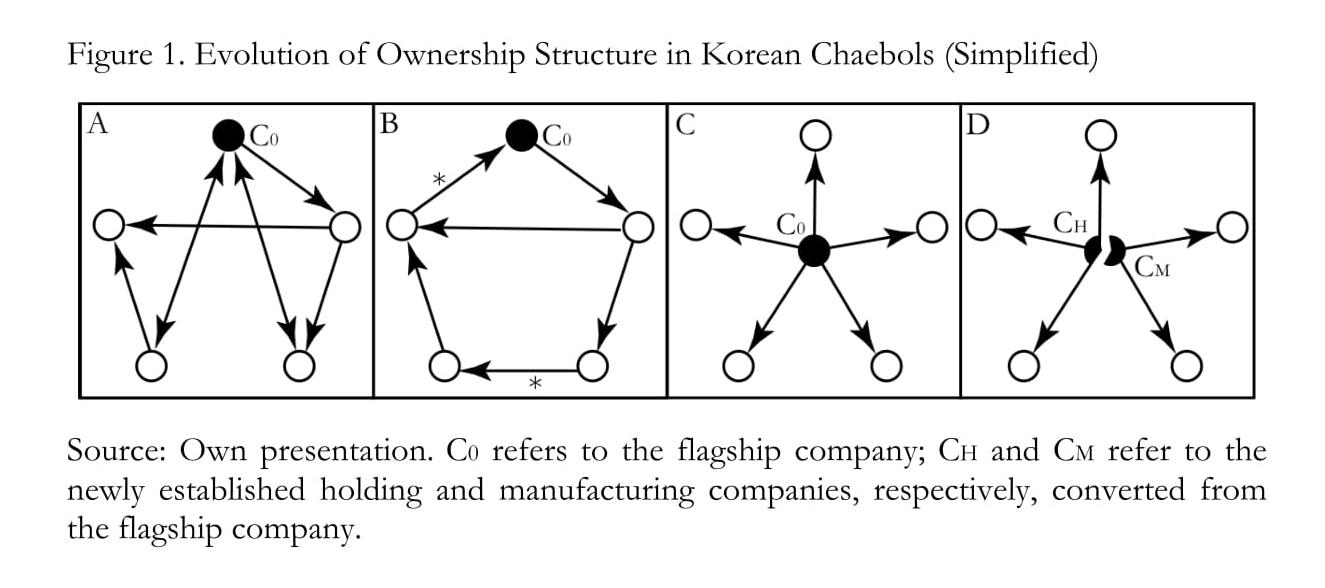

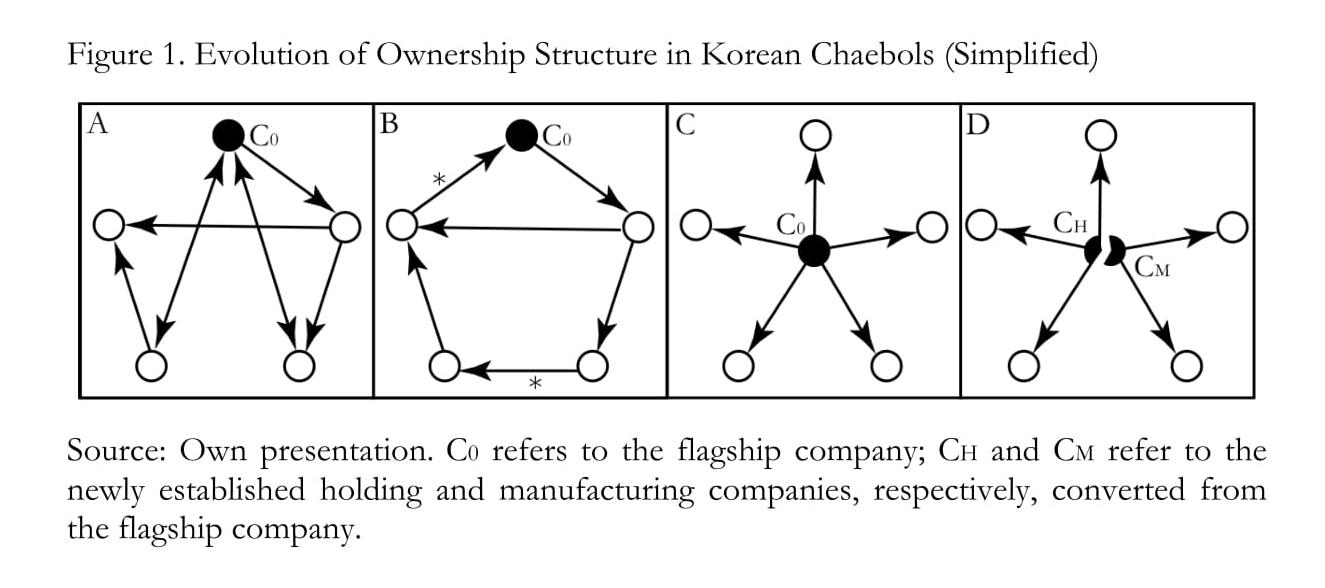

The prime issue of corporate control in Korean chaebols has evolved from the classic oppression of minority shareholders by the ‘Market Rule,’ within the pyramidal holding structure, to the subtle application of the ‘Equal Opportunity Rule’ in the financial market transaction (Bebchuck, 1994). The 1999 Holding Company Act, a major policy reform on ownership structure, provides the relevant policy context for analysis. Figure 1 simplifies the structural nature governing the continuity and change behind the apparent complexity of chaebols.

The bidirectional ownership (Figure 1.A) emerged in the 1970s until this particular structure underwent regulation during the late 1980s. The chaebols circumvented the ban on bidirectional ownership by intensifying the feature of cross-ownership (Figure 1.B). Amid post-crisis concerns, the holding company structure (Figure 1.C) emerged as a secondary solution to reduce structural opacity in the pyramidal structure. Such change would enhance the accountability of the controlling family by inducing them to pay additional capital-in. The Holding Company Act of 1999, (hereafter called, “the Act”), was enacted to help ease the restructuring process. The actual path taken by the chaebols, however, involved the spin-off process (Figure 1.D instead of Figure 1.C), significantly reducing transaction costs for the families.

A Simple Model of Share Buybacks in The Holding Company Act

To understand multigenerational family manager motivations, I focus on their steps undertaken in order to comply with the Act. To model the Act’s impact, I note that α refers to the fraction of family ownership in the flagship company before and in the holding company after (from Figure 1.B to Figure 1.D). β refers to the business-to-business ownership stakes that the holding company comes to hold in the manufacturing company. I consider the central problem of the controlling family owning an insufficient fraction of α. The analysis highlights two mixed findings related to shareholder activism on α and β.

First, I detail how the controlling families in South Korea found novel ways to use the Act to retain family ownership in spite of regulatory intentions. Share buyback programmes were crucial to the maintenance of chaebol (see Lazonick, 2014 for the corporate governance account on share buyback in the United States). The fraction of repurchased shares θ in the flagship company allowed the family managers not only to reduce the share of minority shareholders from 1-α to 1-α-θ but also to increase β by θ through regulatory arbitrage in the tender offer to the holding company structure. Consistent with the reasoning of the analytic narrative, the related data compilations (Ryu and Lee, 2017; Yoo, 2014) show a notable increase in family ownership for both α and β from 0.3 to 0.5~0.6, based on 54 and 36 cases, respectively.

Activist Investor under the Equal Opportunity Rule

Under the Equal Opportunity Rule regime, my model with inclusion of an activist investor suggests that, should an investor take the same measure as the controlling family, the family may fail to gain the necessary threshold in α despite the favorable policy environment; nonetheless, the regulatory benefits from conforming to the Act compel the family to restructure its business group so that the family can increase α in the key listed companies. Therefore, the controlling family would consider the implications of the Equal Opportunity Rule strategically, wherein activist investor can mirror -- and maneuver against the interests of -- the family in the restructuring process.

With activist investors present, the family may execute payout policies on a big scale, and fend off activist investors, while presenting the family management also to uphold shareholder values. The activist investors with short-term interests may exit the flagship company after their retained earnings have been exhausted.

This highlights an important role for the activist investors especially in an economy like South Korea’s. Such investors under the Equal Opportunity Rule have the means to pressure powerful families from abusing the business group system. Bebchuck, Cohen, and Hirst (2017) offer an analytic insight that the incentive for such intervention may be stronger for activist investors than other types of investors. In the economy run by a few corporate families, the criminal investigation reveals that the state-run institutional investor such as National Pension Service rather only had a perverse incentive to side with the entrenched family managers than to provide the legitimate stewardship, exhibiting a form of regulatory capture (Stigler, 1971).

From Analytic Narrative to Empirical Strategy

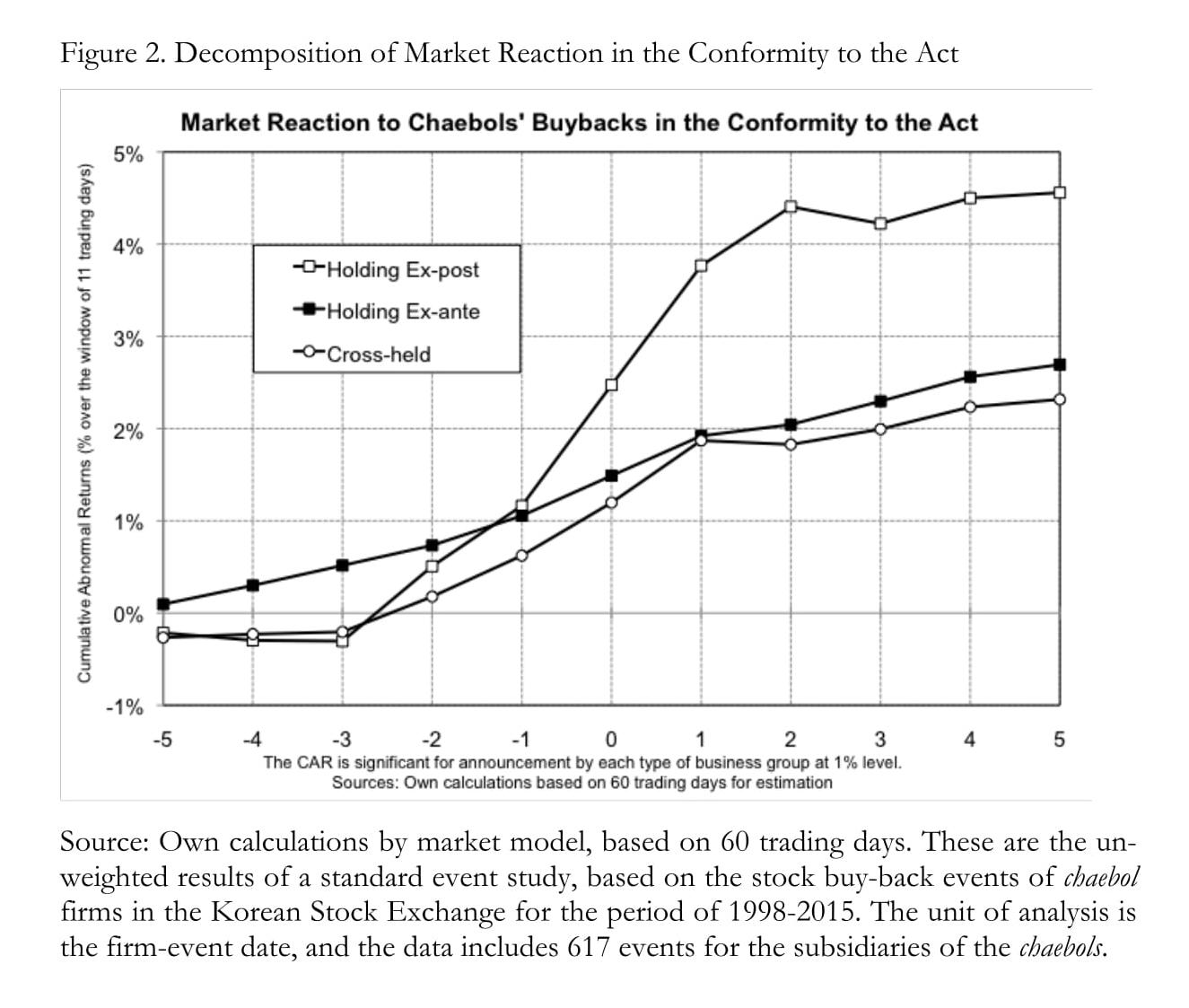

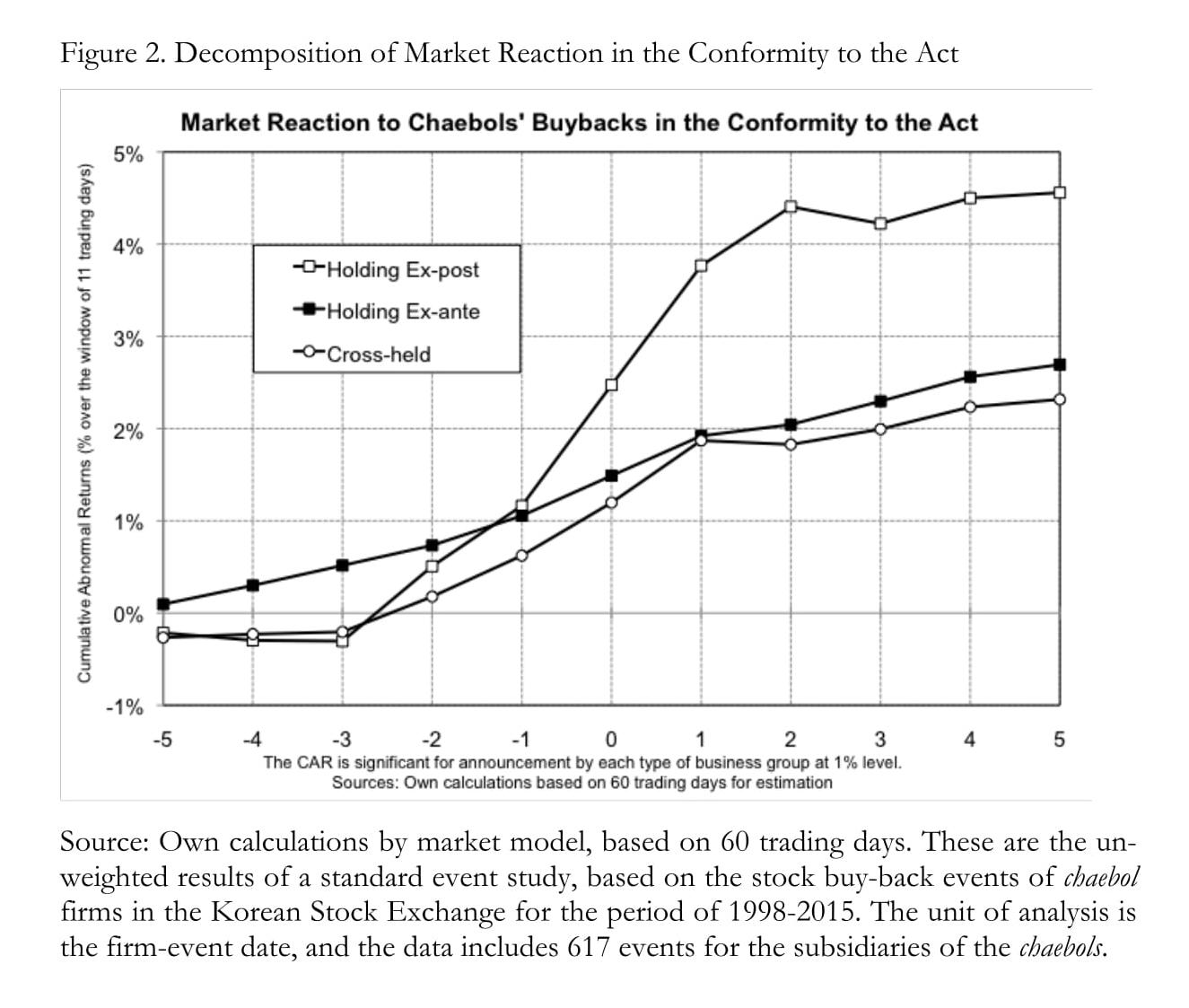

An approach by analytic narrative (Bates et al., 1998) further offers a theoretically grounded empirical strategy; the market may expect the pre-emptive but costly use of payout policies before the essentially family succession scheme. Based on the comprehensive share buyback activities since 1998, I conduct a standard event study to test the hypothesis and, in particular, to better understand investors’ reaction to share buyback events at different stages in the restructuring process.

The ‘cross-held’ represents subsidiaries of the chaebols that remained cross-held during the observation period (1998-2015). The ‘holding ex-ante’ captures sample events for subsidiaries of later holding companies, up until (ex-ante) the restructuring. The ‘holding ex-post’ captures the comparable sample events after (ex-post) the restructuring. All three types in Figure 2 had positive and statistically significant un-weighted return experiences; of those, the holding ex-post differentiates itself significantly from both the cross-held and the holding ex-ante at the 1% level. In other words, the difference is not only between the cross-held and the holding ex-post but also between subsidiaries of the later holding companies ex-ante and ex-post.

I should qualify these tentative results. While the results are robust to the passage of time, other underlying controls are necessary to the extent that the strategic elements of their different choices are likely to indicate potential selection bias. This empirical section is in progress to investigate the underlying determinants of their choices and different investors’ reactions as regards their conformity to the Act. Suggestions are welcomed.

References

Bates, R. H., Greif, A., & Levi, M. (1998). Analytic narratives. Princeton, N.J: Princeton University Press.

Bebchuck, L. A. (1994). ‘Efficient and Inefficient Sales of Corporate Control.’ The Quarterly Journal of Economics, 109(4): 957-993.

Bebchuk, L. A., Cohen, A. and Hirst, S. (2017). ‘The Agency Problems of Institutional Investors.’ Available at SSRN: https://ssrn.com/abstract=2982617

La Porta, R., López-de-Silanes, F., Shleifer, A., and Vishny, R. (1999). ‘Corporate ownership around the world.’ Journal of Finance, 54(2): 471–520.

Lazonick, W. (January 01, 2014) ‘Profits without prosperity,’ Harvard Business Review.

Lee, W. and Ryu, Y.-G. (2017). “54 holding companies, increases family wealth up to KRW 2 trillion in the process,” The Hankyoreh, 2017.02.08, www.hani.co.kr/arti/PRINT/781736.html (accessed 2017.02.09).

Morck, R., Wolfenzon, D., & Yeung, B. (2005). ‘Corporate Governance, Economic Entrenchment, and Growth,’ Journal of Economic Literature, 43(3): 655-720.

Stigler, G. (1971). ‘The Theory of Economic Regulation.’ Bell Journal of Economics and Management Science, 2(3): 3-18.

Yoo, J.-S. (2014). ‘Spin-off into a Holding Company, Stock Share, and Stock Price,’ The Korean Journal of Industrial Organization, 22(2): 73-95. |