Nam Lee

Under what circumstances can a latecomer surge to be the global player?

The Case of Samsung Electronics in Korea

(21/08/2017)

1. Abstract

Samsung Electronics Co. (SEC) was founded as a part of diversification strategy of the Samsung Group in the late 1960s. After four decades in 2009, SEC grew into the world's leading firm in the electronics industry. In this study, major milestones for SEC's dramatic growth have been identified and analyzed as it emerged from a fast-following second-tier OEM manufacturer to one of the most innovating global leader in electronics industry. A large number of studies on SEC have been conducted, but none of them have employed a holistic view and shed light on the dynamic relationships between the Samsung Group and SEC yet, despite the fact that the Samsung Group has played a significant role in nurturing SEC's achievements by providing the resources and capabilities. Also, the scope of most studies has been limited to a specific time period, region, or businesses of SEC. This study aims to address a different perspective to view SEC as an affiliate of the Samsung Group and see SEC as an independent global leader in electronics industry as it stands now. In particular, we focus on identifying SEC's key events that have taken place from the early days in its history to the latest moment from the perspectives of technology catch-up and globalization. We pay special attention to describing the cases objectively by avoiding both lavish compliment on and harsh criticism against specific individuals and SEC. Nonetheless, we do cover important failures including passenger car business and merger of AST, as well as successes that either led to an important organizational learning or had a significant impact on the strategic management and behavior of SEC.

Fig.1 Sales, Operating Income, Operating Margin Rate (Unit in trillion KRW, 1 trillion KRW = 1 billion USD)

2. Introduction and Summary

This study observes SEC from its foundation to recent years with focus on its most emblematic success stories of semiconductors, LCD, TV, and mobile phones. It began as the latecomer and overcame the technological gap with global companies through ownership-based strong leadership, aggressive technology development and marketing, investment in supply chain management, and organizational learning while achieving the globalization of its businesses. The semiconductor business, started in the early 1980s under the founder’s decision, withstood the crisis of losses massive enough to endanger the entire Samsung Group during its early days, made a turn-around in 1988, and has been maintaining its position as the global leader since 1992. The LCD business, launched in the early 1990s based on the successful experience in the semiconductor business, started mass production in 1995, and has been maintaining its top position in the global market since 2002. The TV business, which first began with the production of black-and-white TVs in 1972 through technical licensing agreements with Japanese firms, took 34 years to reach the top global position in 2006. The mobile phone business, although the domestic market share lingered around a meager 10% until the early 1990s since the first product launch in 1988, has grown to a level of recording sales in excess of 300 million by 2013, just 3 years after adopting Android-based smartphone production in 2010.

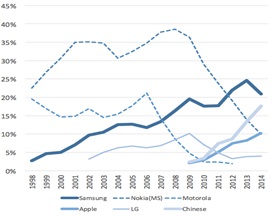

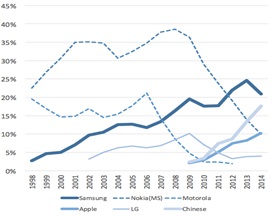

Fig. 2 Worldwide M/S of mobile phones (Chinese M/S includes ZTE, Huawei, TCL, Lenovo and Xiaomi)

Fig.3 Worldwide M/S of D-ram and Display panel

What are the backgrounds behind the success of Samsung Electronics’ flagship products and businesses? The first to note is that long-term investments of at least 10 to sometimes more than 30 years were made on technology development, human resources, marketing, and supply chains. Next, organizational capacity accumulated through learning and experience in the semiconductor and LCD businesses had significant impacts on the mobile phone and TV businesses. Third, the founder and chairman directly or indirectly led decisions related to the establishment and execution of important corporate-level strategies, and demonstrated a powerful driving force.

Fig. 4 R&D Expenditure

Fig. 5 Promotion and Marketing Expenses

On the other hand, the management styles of chaebol conglomerates characterized by fleet-type management of diversified businesses yielded not only success but failure for Samsung as well. Moreover, as in the instances of entry into the automotive and petrochemical businesses and Samsung Electronics’ acquisition of AST, cases – in which the businesses ultimately failed or did not meet expectations due to changes in the management environment or Samsung’s lack of internal capabilities despite the group-wide resources and capabilities – undeniably exist. However, as failures can lead to negative perceptions about the owner and the group, they are kept from the public as much as possible. SEC, the world’s largest electronics company in terms of sales in 2009, just 40 years after its establishment in 1969, has shown phenomenal growth, as to account for 70% of the total sales of the Samsung Group, in terms of 2010 figures. SEC has grown explosively, with its 2013 sales reaching close to 228.7 trillion won, similar to the 2010 total sales of the group, and the Information and Media division that produces mobile phones accounting for approximately ⅓ of the total sales of the Samsung Group. However, for Samsung Group and SEC, the challenges ahead are clear. First, for the businesses in which SEC is the leader, it is now on the other end of the latecomer-leader chase, and it has become difficult to apply the competencies it has built through various businesses in the latecomer position to the current new environment. If the environment changes, the direction of the current strategy should be modified accordingly or even re-established. Furthermore, it requires support from the organization and organizational capability in order to execute the strategy, but a detailed blueprint on how the Samsung Group plans to transform its strategy and organization in response to these issues is yet to be presented from Vice Chairman Lee Jae-Yong, successor to Chairman Lee Kun-Hee. Next, another issue is that the long-term, group-wide new investments that have been made by the founder and Chairman Lee Kun-Hee have been virtually nonexistent since the automotive business. Traditionally, planning team in Chairman’s office was in charge of identifying and executing new businesses for Samsung Group, but it was absorbed by the finance team following the Asian financial crisis (Lee and Lee, 2007). Indeed, what new business will Samsung strategically choose and promote as the next generation of business to follow the semiconductor business must be a tough challenge for Samsung and Korea.

Fig. 6 Operation Income by Business Units

Fig. 7 Sales by Region

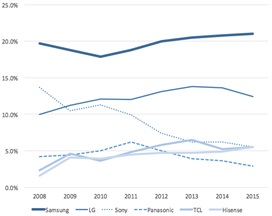

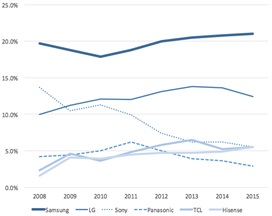

Fig. 8 Worldwide M/S of LCD TV

References

Akamatsu, K. (1961), “A Theory of Unbalanced Growth in the World Economy”. Weltwirtschaftliches Archiv, 86, 196 -217.

Bartlett, C. A. and S. Ghoshal (2002), Managing Across Borders: The Transnational Solution, Boston: Harvard Business School Press.

Chang, S. J. (2003), Foreign Currency Crisis and the Changes of Korean Conglomerates: the Rise and Fall of Chaebol, Parkyoung-sa.

_______________(2008), SONY vs. SAMSUNG, Sallim Biz.

Cho, D. S. (1997), Korean Chaebol, Maekyung Shinmun-sa.

Christensen, C. (1997), The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail, Harvard Business Review Press.

Collins, J. (2009), How The Mighty Fall: And Why Some Companies Never Give In, Collins Business Essentials.

Kim, J. B. (2012), Who Survives Is Not Strong One, But Who Adapts: Success DNAs of the Top 11 Digital Firms from Apple and Google to Samsung and SONY, Sungan-dang.

Kim, L. (1997a), Imitation to Innovation: The Dynamics of Korea's Technological Learning, Harvard Business School Press.

_______ (1997b), “The Dynamics of Samsung's Technological Learning in Semiconductors,” California Management Review, 39( 3), 86-100.

______ (1998), “Crisis Construction and Organizational Learning: Capability Building in Catching-up at Hyundai Motor,” Organization Science, 9(4), 506-521.

Kojima, K. (2000), “The "flying geese" model of Asian economic development: origin, theoretical extensions, and regional policy implications”, Journal of Asian Economics, 11, 375-401.

Lee, K. and C. Lim (2001), “Technological Regimes, Catching-up and Leapfrogging: Findings from the Korean Industries,” Research Policy 30(3), 459-483.

______ and W. Song (2005), “Emerging Digital Technology As a Window of Opportunity and Technological Leapfrogging: Catch-up in Digital TV by the Korean Firms,” International Journal of Technology Management, 29(1-2), 40-63.

Lee, N. S. (2011), "The Evolution Process of Cooperation between Samsung and Nissan over Samsung Motors Inc.,“ Korean Management Review, 40(3), 687-720. Lee, W. H. and N. S. Lee (2007), “Understanding Samsung’s Diversification Strategy: The Case of Samsung Motors Inc.”, Long Range Planning, 40, 488-504.

Nonaka, I. and H. Takeuchi (1995), The Knowledge-Creating Company, Oxford University Press.

Perlmutter, H. V. (1969), “The Tortuous Evolution of the Multinational Corporation,” Columbia Journal of World Business, 9-18.

Rosenzweig, P. (2007), The Halo Effect, The Free Press.

Song, J. Y. and K. M. Lee (2013), Samsung Way: Lee Kun Hee’s Management that Made Samsung a Global Company, 21st Century Books.

Teece, D., G. Pisano and A. Shuen (1997), “Dynamic Capabilities and Strategic Management,” Strategic Management Journal, 18(7), 509-533.

______ (2009), Dynamic Capabilities and Strategic Management, Oxford University Press. |