Hugh WhittakerBuilding a New Economy: Japan’s Digital and Green Economic TransformationsThe key words of this research are: digital, green, change, resilience and capitalism. It asks: How is Japan going about building a new economy? What is new, and what is not? Who are the builders? Is there a design? Will it be successful?

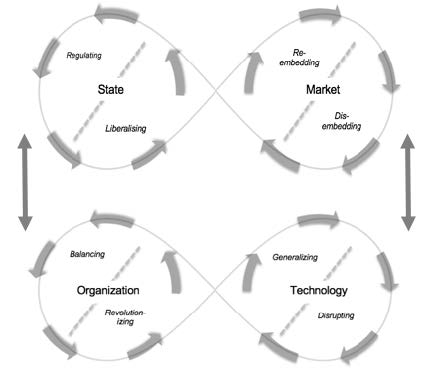

Research statementLike many countries, Japan is currently undergoing a simultaneous digital and green transformation. It is commonly portrayed as a laggard in both, a view partly based on data, and partly an extension of the ‘lost decades’ narrative. Such a view is typically based on explicit or implicit comparative frames of reference, contrasting Japan with the US or Anglophone countries, whose structural or policy changes are accepted as ‘normal.’ These frames persist, even in the midst of a growing sense of crisis about the excesses of neoliberal capitalism in those referent countries. This research seeks to understand Japan’s digital and green transformation in its own terms, while at the same time drawing on a comparative and historical framework which situates Japan in a wider international political economy context. Profound institutional changes are implied by the permeation of digital and green technologies, analogous in some respects to the industrial revolution, which fundamentally changed societies in the nineteenth and twentieth centuries. Such changes, attempted in a historically short time frame, will not be brought about simply by impersonal ‘market forces,’ but will be the result of purposive action by policy makers, entrepreneurs, and civil society groups. Thus the research is titled building – which implies builders – a new economy. Who are these builders, and what kind of economy are they attempting to build? What institutions are they trying to create, or transform; under what visions or ideologies? What do they seek to preserve? Overlapping digital and green transformation, Japan’s political and business leaders have announced the objective of transforming Japanese capitalism – ‘new capitalism’ in the case of current Prime Minister Kishida, and ‘sustainable capitalism’ in the case of Keidanren (Japan Business Federation). Both are expressed in stakeholder terms, and imply ebbing support for neoliberalism, which is implicated in deepening inequality and social cleavage. At the same time, the Tokyo Stock Exchange is being restructured, corporate governance reform continues, and Tokyo seeks to relaunch its claim to being a major financial centre. The latent tensions between these two vectors of change cannot easily be reconciled, even under the banner of ESG (environment, social, governance). How are these tensions perceived, and addressed? Will institutional changes be coherent or piecemeal? What is the real core of the reform agenda? Answering such questions requires an understanding of the past, as well as the present. Japan’s post-war economic ‘miracle’ was built on large-scale manufacturing, supported by ‘patient capital’ and lifetime employment, macroeconomic stability and a range of supportive government financial, industrial and social policies. Institutional compatibility or coherence at both macro and micro levels was a feature. The model came under strain in the 1980s, and as Japan plunged into its ‘lost decades’ in the 1990s, the systemic coherence was lost. This can be seen at the macro level, where household savings remained locked in the banking system, with the banks investing in government bonds, and government debt climbing ever higher. Corporations, meanwhile, sought profitability through cutting labour costs – with negative consequences for demand in the economy – and accumulated massive internal reserves, while the Bank of Japan purchased their shares, eventually becoming the largest holder of Japanese shares (ahead of the Government Pension Investment Fund) in 2021. The macro and micro aspects of the economy were disconnected. What caused this disconnection, and can a new, coherent institutional configuration be constructed which achieves both digital and green objectives, as envisaged for example in Japan’s ‘Society 5.0’ vision, as well as ‘new capitalism’? From existing literature, a number of preliminary answers may be ventured. An optimistic scenario would be something like the following: Scenario 1: Renewal The research is particularly interested in the plausibility of this scenario. Sources of change come from younger bureaucrats in central ministries, from corporations redefining their business domains, and from new public-private networks which sprang up in the wake of the triple earthquake, tsunami and nuclear disaster of 2011. At the same time, a balanced assessment is likely incorporate elements of the following scenarios: Scenario 2: Maturity Scenario 3: Conversion and imitation Scenario 4: Decline Conceptual frameworkThe conceptual framework draws on Whittaker et.al. (2020), especially the organizing constructs of state-market and organization-technology (Figure 1). These broadly correspond to a macro- and micro-level of analysis respectively. The upper dyad shows states and ‘markets’ (encompassing corporations and finance) – a combination familiar to political economy – which mutually interact. The mutual interaction can be supportive or conflictual, and signals a co-evolutionary process. Modern nation states and capitalism emerged together in this process. Figure 1 State-market and organization-technology dyads

Source: Whittaker et.al., 2020 The lower dyad depicts a mutual relationship between organization and technology which is also co-evolutionary; major new technologies give rise to new forms of organization, and vice versa. There are also interactions between the dyadic pairs, indicated by the vertical arrows. Broadly speaking, the lower dyad represents the ‘engine’ of economic growth, and the upper dyad the regulatory mechanisms, which direct resource allocation, and influence incentives, regulation and distribution. Importantly, though not shown in the figure, the dyads of dominant power(s) form the basis of an international geopolitical and economic system, which has a strong influence on institutional development in countries incorporated into the system. The influence depends on the timing of that integration; institutions formed during the process of integration, which often coincides with high growth, subsequently become resistant to change; Britain failed to fully utilize the emerging technologies and organizational forms of the late nineteenth century, Japan has struggled to adapt to those of the late twentieth century. The evolutionary dynamic draws on Polanyi’s (1944) double movement for states and markets, and Bodrožić and Adler’s (2017) revolutionizing and balancing dialectic for organization and technology. In a variation of Hall and Soskice’s (2001) claim that certain varieties of capitalism or economic coordination favour certain types of innovation, it may be that Japan does not excel at Schumpeterian ‘creative destruction’ – the ‘revolutionizing’ phase of Figure 1, but functions better in a ‘balancing’ phase, which we might be entering now with regards digital technologies and platform organization (cf. Lechevalier, 2019). This framework extends an institutionalist perspective to encompass the state, and technology. It overlaps with Régulation perspectives, and is similarly interested in complementarity of institutions. As Boyer (2005) points out, any variety of capitalism, or country, will exhibit a variety of economic coordinating mechanisms, which are not necessarily tightly coupled, and which change over time. Through trial and error, initially disconnected institutional forms may attain a (temporary) coherence. Is there evidence of this happening in Japan? Alternatively, is there evidence of a revival of state influence through industrial policy as a key coordinating mechanism, in other words institutional complementarity through a new turn in state-market relations? The rationale for conducting the research at EHESS in Paris derives from this overlap with French Régulation scholarship, and empirically from the opportunity to understand French and EU approaches to digital and green transformation to create a non-binary comparative understanding of Japan’s economic transformation. The research seeks to combine macroand micro-level empirical data based on extensive interviews in 2021 and 2022, as well as published materials. The approach and some of the ideas have been presented in preliminary form in Whittaker (2021). The anticipated output will be a book. ReferencesBodrožić, Z. and P. Adler (2017), ‘The Evolution of Management Models: A Neo- Schumpeterian Theory,’ in Administrative Science Quarterly, 63(1): 85-129. Boyer, R. (2005), ‘Complementarity in regulation theory,’ in ‘Dialogue on “institutional complementarity and political economy,’ Socio-Economic Review, 3: 359-382. Dore, R. (2009) ‘Japan’s Conversion to Investor Capitalism,’ in D.H. Whittaker and S. Deakin ed.s, Corporate Governance and Managerial Reform in Japan, Oxford: Oxford University Press. Glosserman, B. (2019), Peak Japan: The End of Great Ambitions: Washington DC: Georgetown University Press. Lechevalier, S. (2014), The Great Transformation of Japanese Capitalism, London: Routledge. Lechevalier, S. (2019), ‘Innovation Beyond Technology – Introduction,’ in Innovation Beyond Technology: Science for Society and Interdisciplinary Approaches, edited by S. Lechevalier. Berlin: Springer. Polanyi, K. (1944), The Great Transformation: The Political and Economic Origins of Our Time, New York: Farrar and Rinehart. Schaede, U. (2020), The Business Reinvention of Japan: How to Make Sense of the New Japan and Why It Matters, Stanford: Stanford University Press. Whittaker, D. H. (2021), ‘Beyond Secular Stagnation: A Digital and Green Economy?’ in The Japanese Political Economy, DOI: 10.1080/2329194X.2021.2012806. Whittaker, D. H., T. Sturgeon, T. Okita and T. Zhu (2020), Compressed Development: Time and Timing in Economic and Social Development, Oxford: Oxford University Press. |

|

Recherche |  |

FFJ Research Statement |  |

Hugh Whittaker |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".