Ayako SaikiThe relationship between unconventional monetary policy and income inequality: update20/12/2017

Equality is not just a moral issue. Pursuing equality is conducive to economic growth and financial stability (Ostry et al. 2014; Stiglitz, 2012; Rajan, 2010) and advancing equal opportunity is crucial for sustainable growth. Japan, despite its image as an egalitarian society, has been ranked high in pre-distribution income inequality (as measured by the Gini coefficient), next to the US, Brazil and Luxembourg. Inequality by itself may not really be a problem if everyone becomes better-off; or more specifically, the level of poverty is declining. Unfortunately, according to the OECD, Japan’s relative poverty rate, defined as the share of the population living on less than half of the national median income, is 16.1%, fourth highest among OECD Countries (the US ranked 3rd, at 17.5%, France was at 8.0%, Denmark was the lowest at 5.4%). Japan ranks 34th out of 41 developed nations in the UNICEF child poverty index. While the redistribution effect of fiscal policy is rather obvious, little attention has been paid to the distribution effect of monetary policy.

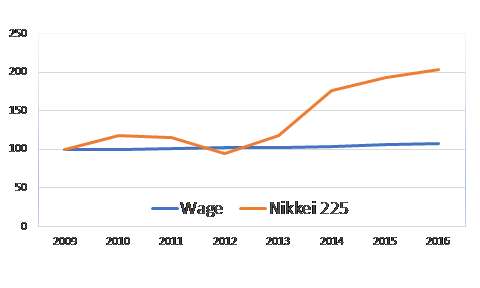

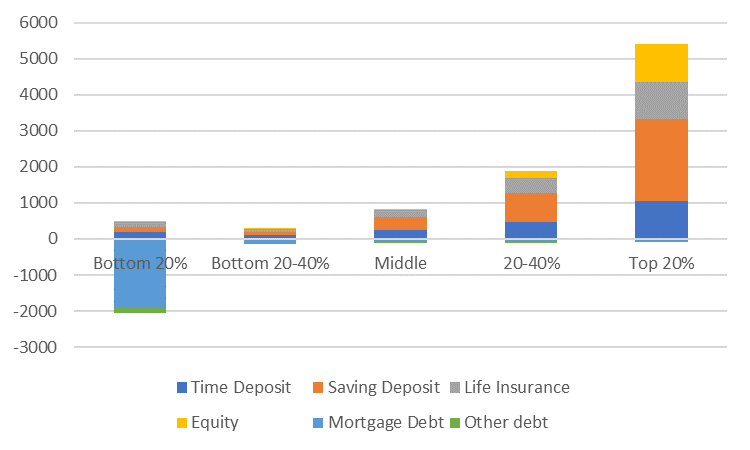

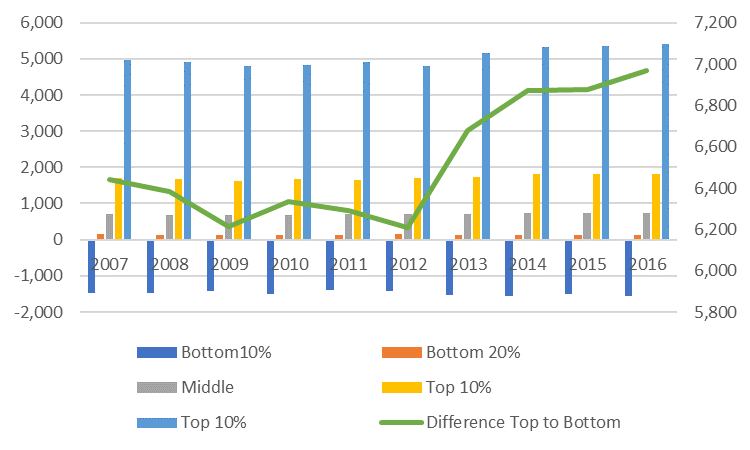

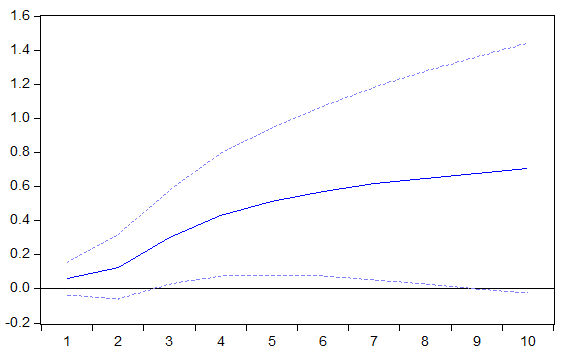

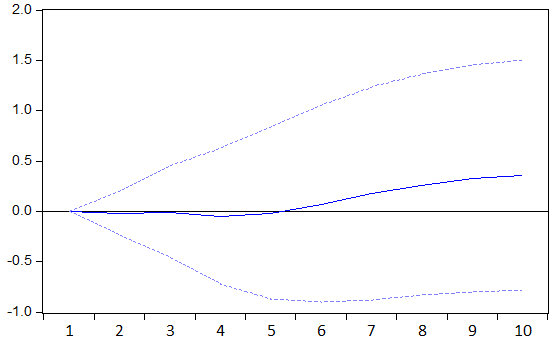

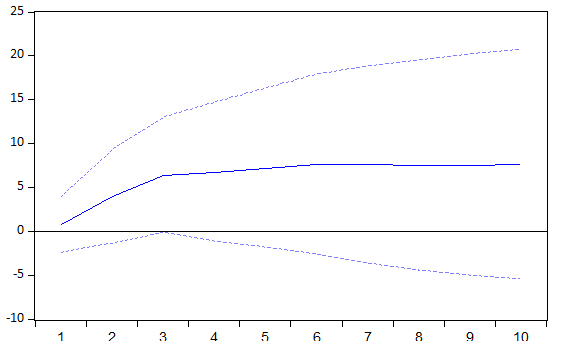

Abenomics started in December 2012, and so far, it is considered to be a success by and large (FT, June 19, 2017). However, the majority of the people do not feel that the economy is growing, which is reflected in the declining consumption per household over the last three years (the government’s household income and expenditure survey). Although there has been some pick-up in wage especially for part-time workers, there has been very little wage growth. On the other hand, equity prices have increased quite substantially. Since Mr. Abe took office, the Nikkei 225 has nearly doubled, while the nominal wage increase has been negligible [Figure 1, below]. Figure 1: Average hourly wage and Nikkei 225 (Index: 2009=100)  Data Source: Ministry of Internal Affairs and Communications(wage), Nikkei (Nikkei 225), Ministry of Internal Affairs Against this backdrop, in 2014, I, with my co-author, published a paper entitled, “Does unconventional monetary policy affect inequality? Evidence from Japan”. In the paper, we showed that Japan’s aggressive monetary policy, especially the one implemented under Abenomics, has widened income inequality via the portfolio channel. There have been some follow-up studies, and one of them is Inui, et al. (2017) which used the shadow interest rate as a policy shock and concluded that the impact of “monetary shock” on inequality is positive, but statistically insignificant. However, one crucial flaw is that their sample period ends in 2008, due to a lack of data. In addition, calculating the shadow interest rate requires strong assumptions, and we cannot consider the change in shadow interest rate as “monetary shock”. The BoJ’s official stance is that their current ultra-easy monetary policy did not worsen income inequality. President Kuroda stated that, “it is my understanding that income inequality is not rising,” on June 2016. However, a few simple statistics do contradict his argument. Figure 2 shows the structure of net assets by quantile. Clearly, equity is held disproportionally by the top 20% (by wealth), while the bottom 20% holds a large amount of mortgage debt, which is somewhat akin to the pre-Lehman looming housing debt. Against these backdrops, the gap of net savings by quantile (the difference between the top 20% and the bottom 20%) has been rising steadily since Mr. Abe took office. Figure 2: Net assets structure held by wealth quantile group  Figure 3: Net savings by quantile  Data Source: Ministry of Internal Affairs and Communications’ household savings and liability survey. The numbers are in 10,000 yen. Saiki and Frost (2014) use the data between 2008Q4 and 2013Q4. The major economic policy event since then is the consumption tax rise for the first time in 17 years, from 5% to 8%, which dented GDP growth substantially (Japan had two-quarters of negative QoQ GDP growth) while inflation has gone up because of the consumption tax. Therefore, I updated Saiki and Frost (2014) with data up to 2017Q1 (the latest data available). Further, I increased the technological sophistication by a notch by using SVAR (structural VAR). The new and more realistic assumption is that a shock to the Gini coefficient only affects itself but not others, both in the short and the long-term. Following Saiki and Frost (2014), I ordered the variables as follows: GDP quarterly growth (seasonally adjusted), core CPI inflation (the BoJ’s target inflation rate), the assets held by the BoJ, the percentage change of the Nikkei 225 index, and finally the Gini coefficient. We controlled for the earthquake effect by including a dummy variable, which takes a value of one between Q2 2011 and Q2 2012. In addition, the consumption tax rise effect was controlled for by including a dummy for Q2 2014 and Q2 2015. The lag length was chosen to be two, which is determined by LR test statistic, FPE (final prediction error) statistic, and Hannan-Quinn information criterion. Both stationarity and cointegration were rejected at the 5% level. The impulse response (accumulated impact) below shows, even clearer than Saiki and Frost (2014), that the effect of the BoJ asset level on the Gini coefficient is significant, and the increase in BoJ assets does not have a statistically significant impact on core inflation, but it does for the stock market (Nikkei 225) and the Gini coefficient. This indicates that the relentless increase in BoJ asset is increasing asset prices, but not inflation. Figure 4: VAR results (inequality measure: Gini Coefficient) Income Gini coefficient’s response to a shock in BoJ asset  Core inflation (YoY)’s response to a shock in BoJ asset  Nikkei 225’s response to a shock in BoJ asset  Granted, Abenomics has not been toothless: although it failed to ignite inflation, exports are solidly growing, and the unemployment rate has dipped below 3%. Mr. Abe has been very proactive in labor market reform: now more women are in the workforce, although they are mainly part-timers, and only few make it to the managerial level. The cultural barrier is very hard to overcome. My point is not that the BoJ should terminate its current unconventional monetary policy for the sake of more equitable distribution of income: the BoJ should stick to the mandate of a de facto inflation target of 2%, otherwise public debt problem would be exacerbated. This study’s intention is just to show the unwanted side-effect of ultra-loose monetary policy. The solution should come from the fiscal side in the short-term, and structural reform in the long-run; higher tax for capital gains is obviously one way to achieve that goal. Frankel (2014) proposes progressive taxation, an earned income tax credit, elimination of payroll taxes for low-income workers, cutting deductions for high-income taxpayers and progressive tax on assets as proposed by Piketty (2013). This would also help Japan to mitigate the government debt problem. ReferencesFrankel, J., 2014, “How to Address Inequality,” VOXEU Column, April 24, 2014. Inui, M., Sudo, N., and Yamada, T., 2017, "Effects of Monetary Policy Shocks on Inequality in Japan," BoJ Working Paper Series. 17-E-3. Ostry, J., Berg, A., and Charalambos, T., 2014, “Redistribution, Inequality, and Growth," IMF Staff Discussion Notes 14/02, International Monetary Fund. Piketty, T., 2013, Capital in the Twenty-First Century, Éditions du Seuil. Saiki, A., and Frost, J., 2014, "Does unconventional monetary policy affect inequality? Evidence from Japan," Applied Economics, Taylor & Francis Journals, vol. 46(36), 4445-4454. Stiglitz, J., 2012, “The Price of Inequality”, Project Syndicate, 5 June. |

|

Recherche |  |

FFJ Research Statement |  |

Ayako Saiki |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".