Yukinobu KitamuraIntergenerational Transfers and Inheritance Tax in JapanIntroductionCurrently I am interested in aspects of intergenerational transfers (bequests and gifts) between generations (mainly through parents to children). This was my D.Phil. thesis topic at Oxford in 1988. Given the rapid aging process and over two decades’ stagnation in Japan, it seems like an opportune moment to rethink how intergenerational transfers matter. My colleague, Chiaki Moriguchi, at Institute of Economic Research in Hitotsubashi University, has collaborated with the leading researcher in this field, Thomas Piketty of EHESS and Emmanuel Saez of UC Berkeley on income distribution project. Through my attachment to EHESS, I plan to extend our collaboration with the French experts.

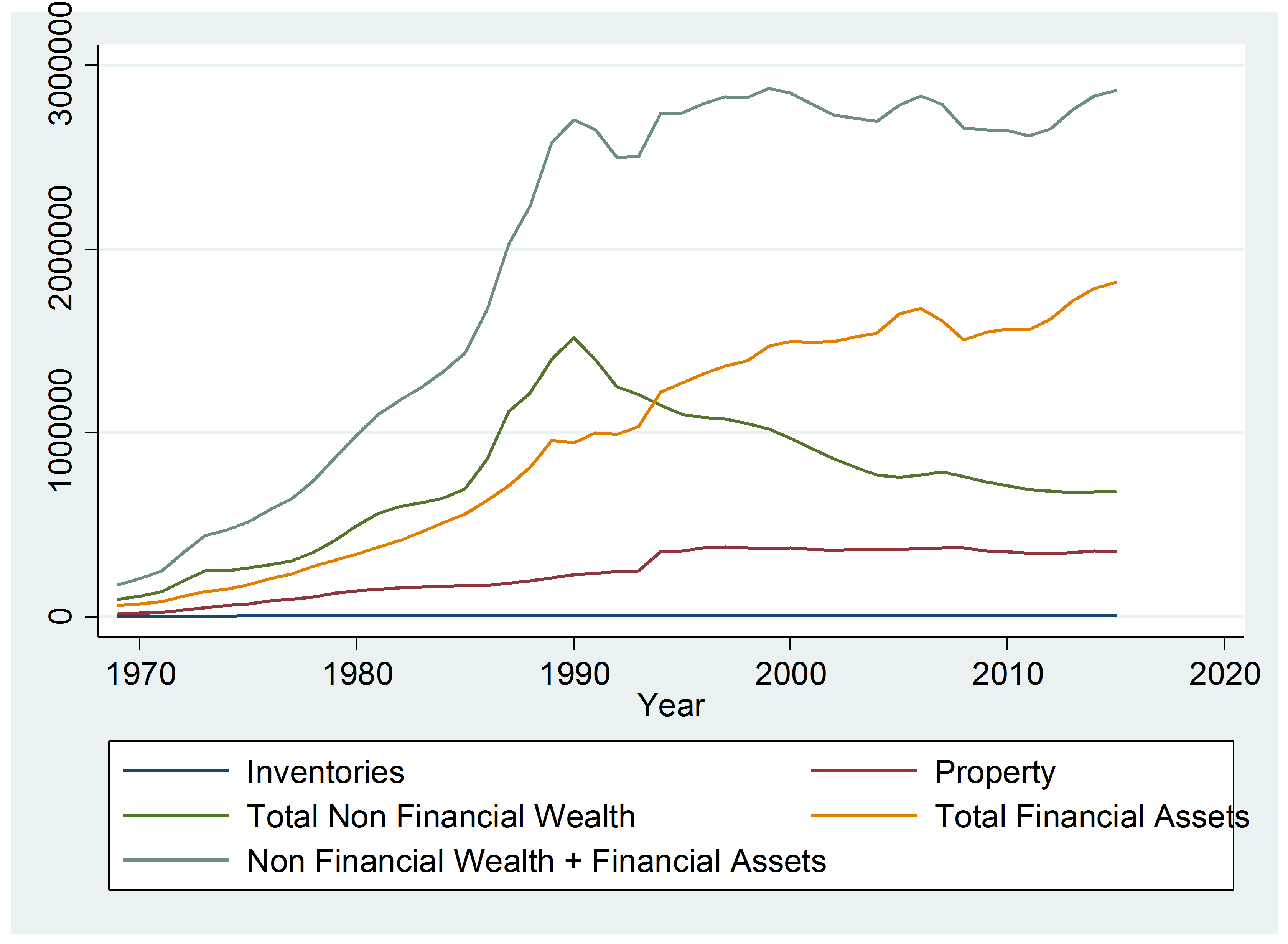

In particular, as the vice chairman of the Statistical Committee, Government of Japan, I have assumed the responsibility to examine and approve official statistics at the government. The committee promotes open access to the broader government statistics, including tax revenue data to the academic research uses. During my attachment to EHESS, it will be productive for me to discuss with the French experts on how the French scholars gained collaborated with the French Tax Authority to use the French Tax data and other official micro dataset. Below presents descriptive, available statistics in line with my research question. Intergenerational Transfers and Household Wealth HoldingsFigure 1 illustrates the historical trend for household wealth. In 2014, according to the SNA statistics, total household wealth accounted for 2727.1 trillion yen, of which non- financial wealth 1031.6 trillion yen and financial wealth 1695.5 trillion yen. Household liabilities (debt) account for 367.7 trillion yen. Therefore, net total wealth accounts for 2359.4 trillion yen.

Figure 1. Historical Trends of Household Wealth

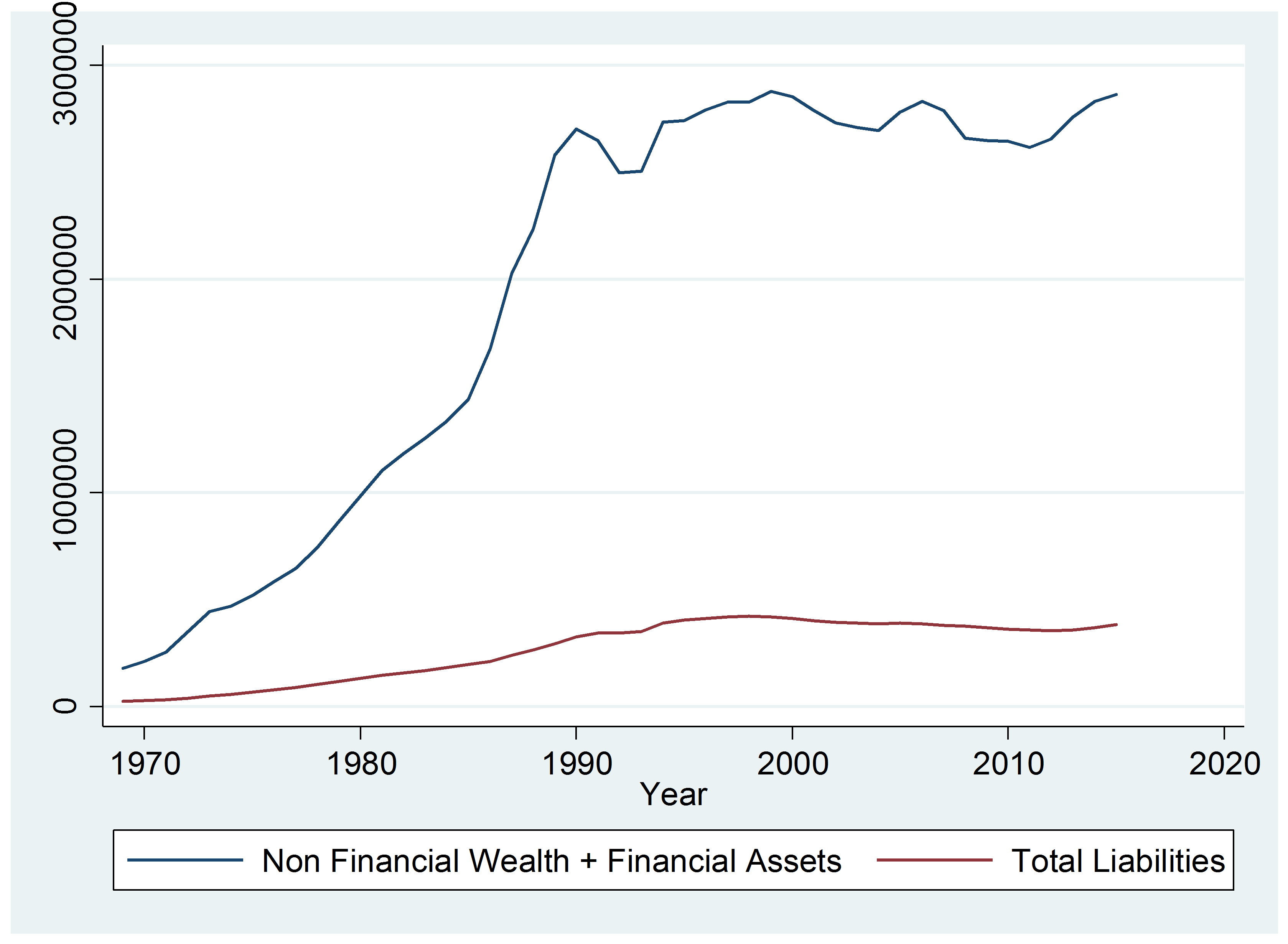

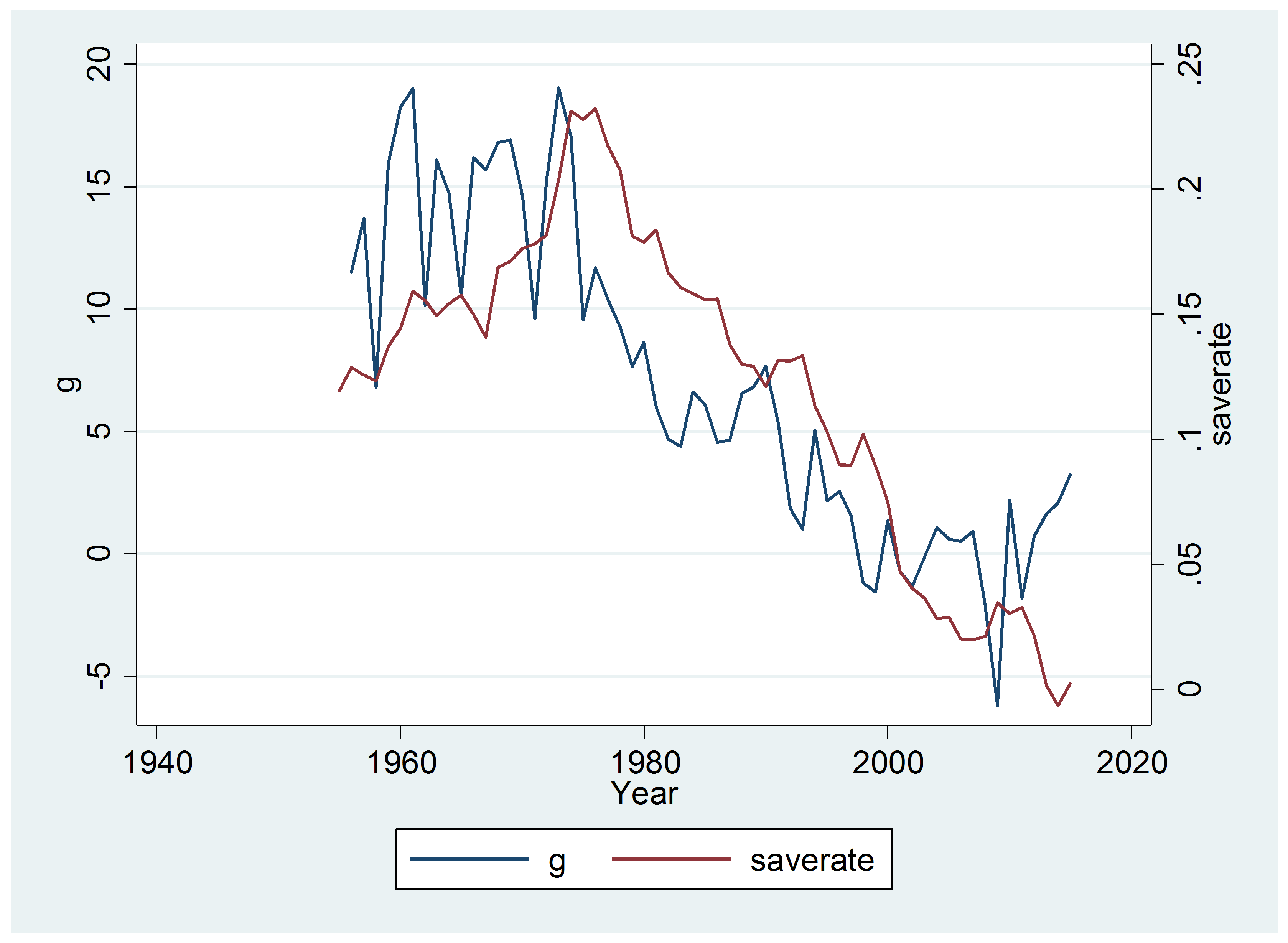

Figure 2 illustrates the historical trends of household wealth vis-à-vis debt level. In 1969, the total household wealth was 176.85 trillion yen, of which non-financial wealth 112.6 trillion yen and financial wealth 64.26 trillion yen. As the household liabilities 24 trillion yen, net total wealth was 152.87 trillion yen. It was only 6 % of net total wealth in 2014. Substantial capital accumulation has been made over the past 50-60 years through high saving rates. Figure 3 illustrates the relationship between the economic growth rate and the household saving rate.

Figure 2. Historical Trends of Total Household Wealth and Debt

Figure 3 shows that decline in the saving rates overtime explains the slowdown of capital accumulation process after the 1990s. At the same time, Figures 1 and 2 together illustrate that household wealth remains more or less the same level since 1990 despite the fact of rapid aging. Recall the life cycle hypothesis of Franco Modigliani predicts that households would de-cumulate wealth as the households age. In this context, the bequest motive of saving model is consistent with the trend in data. Of course, we can reject the possibility of lower growth rate on the increased share of inheritance, aside from the only bequest motive argument (DeLong 2003).

Figure 3. Economics Growth and Household Saving Rate

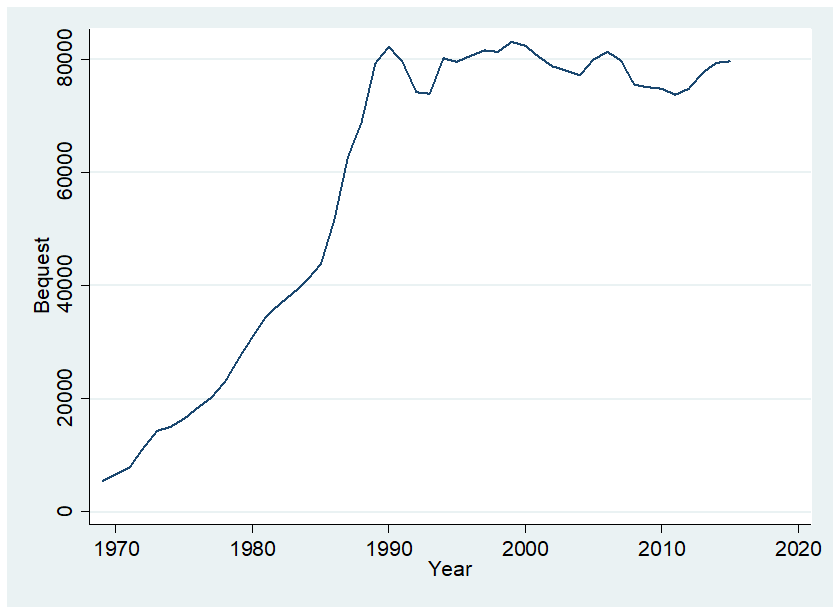

Thomas Piketty proposed a method for calculating how household wealth would transfer to the next generation (i.e., he calculates the wealth-inheritance ratio et, =Wt/Bt, equivalent to a generational length, which is the average age at parenthood). Given the historical record of et in Japan (i.e., 29-30 years old and aggregate household wealth Wt), one can estimate the amount of intergenerational transfer (inheritance in a broad sense), Bt. Figure 4 illustrates its historical trend. It illustrates that a substantial amount of intergenerational transfers has been conducted among the Japanese households whether or not it is based on the bequest motive.

Figure 4. Estimate of Annual Intergenerational Transfers  After the 1990s, annual intergenerational transfers account around 70-80 trillion yen. At the moment, we are calculating bequest transfer at death by using age-wealth distribution data multiplied by total death number by age. Then the gap between annual intergenerational transfers and bequest transfers would yield the gift transfers. Our goal in this project is to identify the size of bequest and gift transfers among household. The policy implication we aim at is to promote the discussion on how the tax authority should handle with gift transfer activities. ReferencesAtkinson, A.B., Backus, P.G. and Micklewright, J.(2009) “Charitable Bequests and Wealth at Death in Great Britain”, University of Southampton, Southermpton Statistical Sciences Research Institute, Working Paper A09/03Backus, Peter (2010) “Is Charity a Homogeneous Good?”, Warwick Economic Research Papers, No.951. Barro, Robert (1976) “Are Government Bonds net Wealth?” Journal of Political Economy, 82(6), 1095-1117. Beckert, Jens(2004)Inherited Wealth, Princeton University Press. Bertocchi, G.(2011) “The Vanishing Bequest Tax: The Comparative Evolution of Bequest Taxation in Historical Perspective”, Economics & Politics, 23. Bruce, Neil and Turnovsky, Stephen, J. (2012) “Social Security, growth, and Welfare in Overlapping Generations Economics with or without Annuities”, mimeo, Department of Economics, University of Washington. Blanchard, Olivier J.(1985) “Debt, Deficits, and Finite Horizons”, Journal of Political Economy. 93(2), pp.223-247. Chamley, Christophe. (1986) “Optimal Taxation of Capital Income in General Equilibrium with Infinite Lives”, Econometrica, 54(3), 607-622. Chamley, Christophe. (2001) “Capital Income Taxation, Wealth Distribution and Borrowing Constraints”, Journal of Public Economics, 79,55-69. Conesa, Juan Carlos, Kitao, Sagiri, and Krueger, Dirk.(2009) “Taxing Capital? Not a bad Idea After All!", American Economic Review, 99(1), 25-48. Cremer, Helmuth, Pestieau, Pierre, Rochet, Jean-Charles. (2003) “Capital Income Taxation When Inherited Wealth is not Observable”, Journal of Public Economics, 87, 2475-2490. Cunliffe, John and Erreygers, Guido (eds) (2013) Inherited Wealth, Justice and Equity, Routledge. De la Croix, David. (2015) “Did longer Lives Buy Economic Growth? From Malthus to Lucas and Ben-Porath”, Discussion Paper 2015-12, Institute de Recherches Economiques et Sociales de I’Universite catholique de Louvain. Diamond, Peter A.(1965) “National Debt in a Neoclassical Growth Model”, American Economic Review, 55, 1126-1150. Doepke, Matthias and Zilibotti, Fabrizio. (2012) “Parenting with Style: Altruism and Paternalism in Intergenerational Preference Transmission”, mimeo. Duff, D.G.(2005) “The Abolition of Wealth Transfer Taxes: Lessons from Canada, Austrakia and New Zealand”, Pittsburgh Tax Review, 71, 71-120. Ewald, Christian-Oliver, Nolan, Charles and Zhang, Aihua.(2015) “Debt, Deficits, and Finite Horizons: The Continuous Time Stochastic Case”, mimeo. Farhi, Emmanuel and Werning, Iván (2010) “Progressive Estate Taxation”, Quarterly Journal of Economics, May 2010, pp.635-673. Farhi, Emmanuel and Werning, Iván (2013) “Estate Taxation with Altruism Heterogeneity”, American Economic Review, Papers and Proceedings, 103(3), 489-495. Farhi, Emmanuel and Werning, Iván (2014) “Bequest Taxation and r-g”, Harvard and MIT, mimeo. Farmer, Roger E.A., Nourry, Carine and Venditti, Alain.(2011) “Debt, Defictis and Finite Horizons: The Stochastic Case”, Economics letters, 111, 47-49. Hines, James, R, Jr. (2013) “Income and Substitution Effects of Estate Taxation”, American Economic Review, 103(3), 484-488. Jappelli, T. et al. (2011) “Transfer Taxes and Inequality”, GINI Discussion Paper, No. 21. Judd, Kenneth L.(1985) “Redistributive Taxation in A Simple Perfect Foresight Model”, Journal of Public Economics, 28 , 59-83. Judd, Kenneth L.(1999) “Optimal Taxation and Spending in General Competitive Growth Models”, Journal of Public Economics, 71, 1-26. Kocherlakota, Narayana R.(2010) The New Dynamic Public Finance, Princeton University Press. Kopczuk, Wojciech.(2013) “Incentive Effects of Inheritances and optimal Estate Taxation”, American Economic Review, 103(3), 472-477. Kopczuk, Wojciech (2013) “Taxation of Intergenerational Transfers and Wealth”, Handbook of Public Economics, Vol. 5, Chapter 6, 329-390. McGarry, Kathleen. (2013) “The Estate Tax and Inter Vivos Transfers over Time”, American Economic Review, 103(3), 478 -483. Levy, Gilberto and Levin, Bruce.(2014) The Biostatistics of Aging, Wiley. Liang, James, Wang, Hui and Lazear, Edward P.(2014) “Demographics and Entrepreneurship”, NBER Working paper, No.20506. Lotka, Alfred J.(1922) “The Stability of the Normal Age Distribution”, Proceedings of the National Academy of Sciences of the United States of America, vol.8, No.11, pp.339-345. Lotka, Alfred J.(1939) “A Contribution to The Theory of Self-Renewing Aggregates, with special reference to Industrial Replacement”, The Annals of Mathematical Statistics, 10, 1-25. Lotka, Alfred J.(1998) Analytical Theory of Biological Populations, Plenum press. Mierau, Jochen O. and Turnovsky, Stephen J. (2014) “Demography, Grwoth and Inequality”, Economic Theory, 55, 29-68. Mirrlees, James A.(1972) “Population Policy and The Taxation of Family Size”, Journal of Public Economics, 1, 169-198. Oxborrow, David and Turnovsky, Stephen J.(2015) “Closing the Small Open Economy Model: A Demographic Approach”, mimeo. Piketty, Thomas.(2010) “On the Long-Run Evolution of Inheritance: France 1820-2050”, Quarterly Journal of Economics, 126(3), 1071-1131. Piketty, Thomas and Emmanuel, Saez (2012) “A Theory of Optimal Capital Taxation”, NBER Working Paper Series, no.17989. Piketty, Thomas and Emmanuel, Saez (2013a) “A Theory of Optimal Inheritance Taxation”, Econometrica, 81(5), 1851-1886. Piketty, Thomas and Emmanuel, Saez (2013b) “Optimal Labout Income Taxation”, Handbook of Public Economics, vol.5, pp.391-474. Piketty, Thomas. (2014) Capital in the Twenty-First Century, Harvard University Press. Razin, Assaf and Sadka, Efraim (1995) Population Economics, MIT Press. Salanié, Bernard.(2003) The Economics of Taxation, MIT Press. Samuelson ,Paul, A.(1958) “An Exact Consumption-Loan model of Interest with or without the Social Contrivance of Money”, Journal of Political Economy, 66, 467-482. Sheshinski, Eytan. (2008) The Economic Theory of Annuities, Princeton University Press. Turnovsky, Stephen J.(2000) “Growth in an Open Economy: Some Recent Developments”, Working Papers-Research Series, No.5 (May 2000), National bank of Belgium. Werning, Iván (2011) “Nonlinear Capital Taxation”, MIT, mimeo. |

|

Recherche |  |

FFJ Research Statement |  |

Yukinobu Kitamura |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".