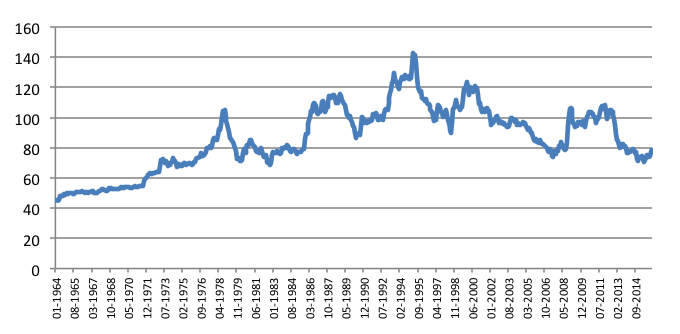

Ulrich VOLZJapanese Monetary and Exchange Rate Policy and the Hollowing-out of Japanese IndustryA strong yen—endaka (円高) in Japanese—has repeatedly cause distress among Japanese policymakers and manufacturers. Since the demise of the Bretton Woods system in 1971, the yen has seen several episodes of strong appreciation, including in the late 1970s, after the 1985 Plaza Agreement, the early and late 1990s and after 2008 (Figure 1). These appreciations have not only been associated with “expensive yen recessions”—endaka fukyo (円高不況) in Japanese—resulting from negative effects on exports, since the late 1980s the strong yen has also raised concern about a de-industrialisation of the Japanese economy.

Figure 1: Real effective exchange rate of the Japanese yen (2010=100)

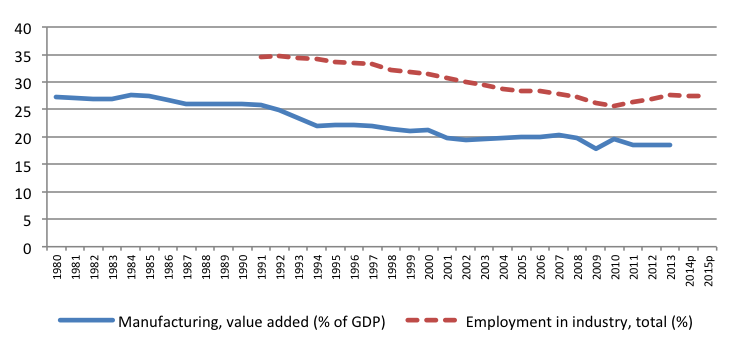

Source: BIS Effective Exchange Rate Indices (updated 16 March 2016), www.bis.org/statistics/eer.htm. Indeed, the share of manufacturing in total output has declined from 27.2% in 1980 to 18.5% in 2013, while employment in industry as share of total employment has declined from 34.6% to 27.4% between 1991 and 2015 (Figure 2).

Figure 2:Manufacturing as share of GDP and employment in industry as share of total

Source: Compiled with data from World Development Indicators and ILO Global Employment Trends databases, April 2016. While the strong yen and its potentially de-industrialising effect has received much attention in the political and economic policy discourse in Japan, there has been surprisingly little research in the academic literature. As pointed out by Hamada and Okada (2009: 200), most research on Japan’s “lost decade” and hollowing out of the Japanese industry “have been broadly focused on its real and domestic aspects, such as total factor productivity (TPF), growth decline, non-performing loans, and governance.” Hamada and Okada (2009: 200) argue that monetary and exchange rate policy have played an important role in this, and that “Japanese industries endured a heavy burden” due to a greatly overvalued real exchange rate.

It is well established that depreciated real exchange rates can help to stimulate industrial development and economic growth (Rodrik, 2008). Although there seems to exist a “fear of appreciation” (Levy-Yeyati et al., 2013) relatively little research has been conducted on the effect of overvalued exchange rates on economies. The first systematic empirical cross-country analysis to investigate the effects of large exchange rate appreciation on current account balances and on real output was conducted by Kappler et al. (2013), who find that episodes of strong exchange rate appreciations are associated with deteriorating current account balances and a slow-down of real export growth, but no significant effects on output. Likewise, Bussière at al. (2015) examine to what extent large and rapid real exchange rate appreciations impact on economic growth. Using a sample of 53 emerging and advanced economies they find that while large appreciations dampen export growth and boost import growth, output growth is higher on average.

The literature on de-industrialisation has focused less on exchange rate valuations than on changes in specialisation, consumption, technological progress and productivity, international trade and investment patterns (Rowthorn and Coutts, 2004). The major exemption is the US economy, for which the effect of the dollar exchange rate on the US industry has been studied widely (e.g., Glick and Hutchison, 1990; Goldberg, 1993; Campa and Goldberg, 1995; Kletzer, 2000). Surprisingly few studies have looked into the potentially de-industrialising effect of endeka, even though Obstfeld (2010) pointed out that Japan’s real economic growth rate has been strongly negatively correlated with the level of the yen’s real effective exchange rate. Only few studies can be found that systematically try to verify the hypothesis that the strong yen has contributed to de-industrialisation and outsourcing of industry in Japan, including Dekle (1996), Dekle et al. (2010) and Yamashita (2013). Likewise, there is little research on the regional dimension of Japan’s hollowing out.

Against this backdrop, this research project aims to investigate the effects of Japanese monetary and exchange rate policy on the hollowing out of the Japanese industrial sector. To this end, the first part of the study will constitute of an econometric analysis using new data for industry‐specific real effective exchange rates (Sato et al., 2013; RIETI, 2016) to gauge the effects of yen fluctuations on the output and exports of different Japanese industries, taking account also of real and monetary variables. The second part of the study will comprise a detailed investigation of the drivers behind the outsourcing of domestic manufacturing production from Japan to other parts of Asia and the role that the yen’s external value has played in the emergence of the regional trade production network. This would also include an analysis of domestic economic reforms and industrial policies in Japan, as well as the changing regional context in Asia with the economic rise of Korea and China in particular.

This research is not only of relevance to the Japanese economy, it also bears relevance for European economies. Indeed, recent years have seen an intense discussion in several member countries of the Eurozone about purported negative effects of a too high euro exchange rate on manufacturing and employment (e.g., Belke and Volz, 2015). For instance, Bénassy-Quéré et al. (2014: 7) estimate that for France “a 10% depreciation in the euro in relation to a partner country outside the eurozone increases the value of the average exporter’s sales to this country by around 5-6%”, with most of this effect realised in the same year as the depreciation. A better understanding of the effect of the exchange rate on Japanese manufacturing should also provide insights for European economic and monetary policy.

References

Belke, Ansgar H. and Ulrich Volz (2015), “The Strong Euro: Challenges for the European Central Bank and Implications for the Global Economy.” AEI Insights 1 (1), pp. 53-68.

Bénassy-Quéré, Agnès, Pierre-Olivier Gourinchas, Philippe Martin and Guillaume Plantin (2014), “The Euro in the ‘Currency War.’ Policy Insights No. 70, London: Centre for Economic Policy Research.

Bussière, Matthieu, Claude Lopez and Cédric Tille (2015), “Currency Crises in Reverse: Do Large Real Exchange Rate Appreciations Matter for Growth?” Economic Policy 30 (81).

Bussière, Matthieu, Sweta Saxena and Camilo Tovar (2012), “Chronicle of Large Currency Devaluations: Re-examining the Effects on Output.” Journal of International Money and Finance 31 (4), pp. 680-708.

Campa, José, and Linda S. Goldberg (1995), “Investment in Manufacturing, Exchange Rates and External Exposure.” Journal of International Economics 38 (May), pp. 297-320.

Dekle, Robert (1996), “Endaka and Japanese Employment Adjustment.” Center on Japanese Economy and Business Working Papers No. 113, New York, NY: Graduate School of Business, Columbia University.

Robert Dekle, Kyoji Fukao and Murat Ungor (2010), “The Japan-US Exchange Rate, Productivity, and the Competitiveness of Japanese Industries.” In Koichi Hamada, Anil K. Kashyap and David E. Weinstein (eds.), Japan’s Bubble, Deflation, and Long-term Stagnation, Cambridge, MA: MIT Press.

Glick, Reuven and Michael M. Hutchison (1990), “Does Exchange Rate Appreciation ‘Deindustrialize’ the Open Economy? A Critique of U.S. Evidence.” Economic Inquiry 28 (1), pp. 19-37.

Goldberg, Linda (1993), “Exchange Rates and Investment in United States Industry.” Review of Economics and Statistics. 75 (4), pp. 575-588.

Hamada, Koichi and Yasushi Okada (2009), “Monetary and International Factors Behind Japan’s Lost Decade: From the Plaza Accord to the Great Intervention.” Journal of the Japanese and International Economies 23, pp. 200-219.

Kappler, Marcus, Helmut Reisen, Moritz Schularick and Edouard Turkisch (2013), “The Macroeconomic Effects of Large Exchange Rate Appreciations.” Open Economies Review 24 (3), pp. 471-494.

Kletzer, Lori G. (2000), “Trade and Job Loss in U.S. Manufacturing, 1979-94.” In Robert C. Feenstra, The Impact of International Trade on Wages, Chicago, IL: Chicago University Press.

Levy-Yeyati, Eduardo, Federico Sturzenegger and Pablo Alfredo Gluzmann (2013), “Fear of Appreciation.” Journal of Development Economics 101 (C), pp. 233-247.

Obstfeld, Maurice (2010), “Time of Troubles: The Yen and Japan's Economy, 1985-2008.” In Koichi Hamada, Anil K. Kashyap and David E. Weinstein (eds.), Japan’s Bubble, Deflation, and Long-term Stagnation, Cambridge, MA: MIT Press.

RIETI (2016), Industry-Specific Nominal and Real Effective Exchange Rates of 18 Countries Worldwide, www.rieti.go.jp/users/eeri/en/

Rodrik, Dani (2008), “The Real Exchange Rate and Economic Growth: Theory and Evidence”, Brookings Papers on Economic Activity Fall, pp. 365-412.

Rowthorn, Robert and Ken Coutts (2004), “De-industrialisation and the Balance of Payments in Advanced Economies.” Cambridge Journal of Economics 28 (5), 767-790.

Sato, Kiyotaka, Junko Shimizu, Nagendra Shrestha and Shajuan Zhang (2013), “Industry‐specific Real Effective Exchange Rates and Export Price Competitiveness: The Cases of Japan, China, and Korea.” Asian Economic Policy Review. 8 (2), pp. 298-321.

Yamashita, Takayuki (2013), “Exchange Rates and Deindustrialization: Japanese Experiences.” Mimeo, Shizuoka: Shizuoka University.

|

|

Recherche |  |

FFJ Research Statement |  |

Ulrich VOLZ |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".