Takeki SUNAKAWAImplications of the effective lower bound on nominal interest rates in the Japanese economy

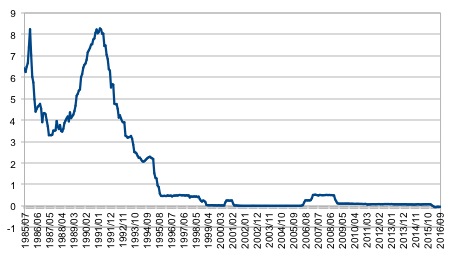

Background As it is well known, the Japanese economy has been stuck in a liquidity trap for more than two decades. After the collapse of the bubble economy in the late 1980s, the Bank of Japan lowered its target for the uncollateralized overnight call rate to 0.5% in 1995. Since then, the call rate has been almost zero (Figure 1) and even negative after the bank launched the negative interest-rate policy in January 2016. In this period, the real growth rate has been below 1%, and the economy is stuck in deflation. Nominal gross domestic product in 2013 is at the same level as it was at in 1991 (in Japanese yen). National labor income has decreased since its peak in 1997.  Figure 1: Uncollateralized Overnight Call Rates. Source: Bank of Japan.

When the economy is in a recession, central banks reduce the nominal interest rate so as to stimulate the economy. However, when the recession is severe, the required reduction of the interest rate is so large that they face the effective lower bound (ELB) on nominal interest rates.[1] In this situation, which actually occurred in the late 1990s in Japan and in the financial crisis in most of the other developed countries such as the U.S. and the euro area, central banks need to conduct unconventional monetary policies.

The Bank of Japan also has conducted unconventional monetary policies such as quantitative easing (QE) and qualitative and quantitative easing (QQE) policies from 2001 to 2006 and from 2013 to the present. The Bank aimed to increase the quantity of money in the economy by purchasing Japanese government bonds and other assets. In addition, the Bank set a target of 2% inflation beginning in 2013 and announced that the Bank will keep the nominal interest rates low for a considerable time after the target is achieved.[2]

Despite these facts, research into the Japanese economy under the ELB, that is, the liquidity trap, is very limited, especially in the framework of dynamic stochastic general equilibrium (DSGE) models, which is developed in modern macroeconomics. This is because the effect of the ELB would be quite nonlinear, as the nominal interest rates cannot be too low or negative and the conventional interest-rate policies are not effective at the ELB. This nonlinearity is difficult to account for in the usual framework.

In the research at Fondation France-Japon de l’EHESS under the Banque de France fellowship, we would like to incorporate the features stated above into a DSGE model. Specifically, we will use a New Keynesian DSGE model incorporating the ELB. These features are relevant to the Japanese economy and actual conduct of monetary policy in the lost decades. Currently we have two projects related to the ELB and the Japanese economy. One is about estimating the output gap and the natural rate of interest in the Japanese economy. This is of particular interest when we consider the fact that the Japanese economy has faced the ELB since the late 1990s. The other project is to examine the credibility of forward guidance policies, which have also been conducted by the Bank of Japan as a part of the QE and QQE policies.

Estimating the output gap

The output gap is the gap between the actual output and the potential output of the economy. In the recent financial crisis, the output gap dramatically dropped and the recovery from such a severe recession is still weak. Also the growth rate of the potential output may be lower than before, which is known as the secular stagnation (c.f., Summers 2016). In this situation, measuring the potential output and the output gap becomes even difficult but important for economists.

The potential output is closely related to the natural rate of interest, which is a hypothetical real interest rate under with the output gap would be zero.[3] When the real interest rate is above (below) the natural rate, it has a negative (positive) impact on the output gap. Central banks also pay much attention to the natural rate of interest as they aim to reduce unnecessary economic fluctuations.

We estimate the output gap and the natural rate of interest in a consistent way with a fully specified non-linear DSGE model (Hirose and Naganuma 2010; Justiniano et al. 2013). We explicitly consider the ELB of the nominal interest rate in our estimation. There are many papers that conduct Bayesian DSGE estimations of the Japanese economy and estimate the output gap. Most of them, however, use the data until the late 1990s, as the economy has been subject to the ELB after that (e.g., Sugo and Ueda 2008; Ichiue, Kurozumi and Sunakawa 2013).

In the present analysis, we use our estimated output gap for policy analyses. For example, what kind of exogenous shocks to the economy has contributed to the long-lasting recession (i.e., a negative output gap) in Japan? We answer this question by using our model. Also we aim to conduct counter-factual simulations, for example, examining the influence of more expansionary monetary policies in the model than the actual policy conducted by the Bank of Japan in 2000s.

Credibility and forward guidance

The forward guidance policy is one of the unconventional monetary policies. Under the forward guidance policy, central banks announce the likely future course of their policy. For example, in December 2008, in the aftermath of the financial crisis, the Federal Market Operation Committee anticipated that weak economic conditions were likely to warrant exceptionally low levels of the federal funds rate for some time. Also when the Bank of Japan set the 2% inflation target in April 2013, the Bank announced to keep the nominal interest rates low for a considerable time after the target is achieved.

The effectiveness of forward guidance crucially depends on the central bank’s credibility. The policymaker may have an incentive to raise the interest rate earlier than they originally announced. If households and firms believe that the policymaker will actually do so, households and firms will not take the policymaker’s announce at its face value.

We examine the credibility of central banks when the nominal interest rate is at the ELB. The optimal commitment policy, which is a particular form of the forward guidance policy, can mitigate the economy even with the presence of the ELB. Under this policy, the policymaker commits to keep the policy rate at the ELB for an extended period so that inflation and the output gap will overshoot its target in the long run (Eggertsson and Woodford 2003). However, it is well known that the optimal commitment policy may not be time-consistent. That is, the policymaker has an incentive to revise its plan to keep the policy rate low for an extended period once the target of inflation and the output gap is achieved. Thus, households and firms do not believe the policymaker’s commitment and the effect of such a commitment is limited.[4]

In the present analysis, we consider a time-consistent policy, under which the policymaker can maintain its credibility among households and firms in a forward-looking manner (c.f., Nakata 2014; Sunakawa 2015). An investigation on the time-consistent policy is important when we consider the actual conduct and the credibility of the forward guidance policy.

References

Eggertsson, Gauti B. and Michael Woodford, 2003. "The Zero Bound on Interest Rates and Optimal Monetary Policy," Brookings Papers on Economic Activity, vol. 34(1), pages 139-235.

Hirose, Yasuo and Saori Naganuma, 2010. "Structural Estimation Of The Output Gap: A Bayesian Dsge Approach," Economic Inquiry, vol. 48(4), pages 864-879.

Ichiue, Hibiki, Takushi Kurozumi and Takeki Sunakawa, 2013. "Inflation Dynamics And Labor Market Specifications: A Bayesian Dynamic Stochastic General Equilibrium Approach For Japan's Economy," Economic Inquiry, vol. 51(1), pages 273-287.

Justiniano, Alejandro, Giorgio E. Primiceri and Andrea Tambalotti, 2013. "Is There a Trade-Off between Inflation and Output Stabilization?," American Economic Journal: Macroeconomics, vol. 5(2), pages 1-31.

Nakata, Taisuke, 2014. "Reputation and Liquidity Traps," Finance and Economics Discussion Series 2014-50, Board of Governors of the Federal Reserve System (U.S.).

Nakata, Taisuke, 2015. "Credibility of Optimal Forward Guidance at the Interest Rate Lower Bound," FEDS Notes 2015-08-27, Board of Governors of the Federal Reserve System (U.S.).

Sugo, Tomohiro and Kozo Ueda, 2008. "Estimating a dynamic stochastic general equilibrium model for Japan," Journal of the Japanese and International Economies, vol. 22(4), pages 476-502.

Summers, Lawrence H., 2016. "Secular Stagnation and Monetary Policy," Federal Reserve Bank of St. Louis Review, vol. 98(2), pages 93-110.

Sunakawa, Takeki, 2015. "A quantitative analysis of optimal sustainable monetary policies," Journal of Economic Dynamics and Control, vol. 52(C), pages 119-135.

[1] In the liquidity trap, the nominal interest rate cannot be too low or negative as there is a benefit of holding cash under a threshold of nominal interest rate. It is still true even though some central banks recently adapted the negative interest-rate policy in the euro area and Japan.

[2] In January 2016, the Bank launched the negative interest-rate policy to argument the QQE in order to stimulate the economy. From September 2016, further the bank aims to control the long-term nominal interest rate as well as the short-term nominal interest rate, which is called the yield-curve control policy.

[3] The real interest rate is the nominal interest rate minus the expected inflation rate. Central banks usually aim to control the nominal interest rate. If the nominal interest rate is subject to the ELB, central banks still can lower the real interest rate by changing expected inflation among households and firms.

[4] For a more detailed explanation of the time-inconsistency under the ELB, see Nakata (2015).

|

|

Recherche |  |

FFJ Research Statement |  |

Takeki SUNAKAWA |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".