Yuko UENOFormation process of Japanese consumers' inflation expectations

Trends of inflation expectations in Japan

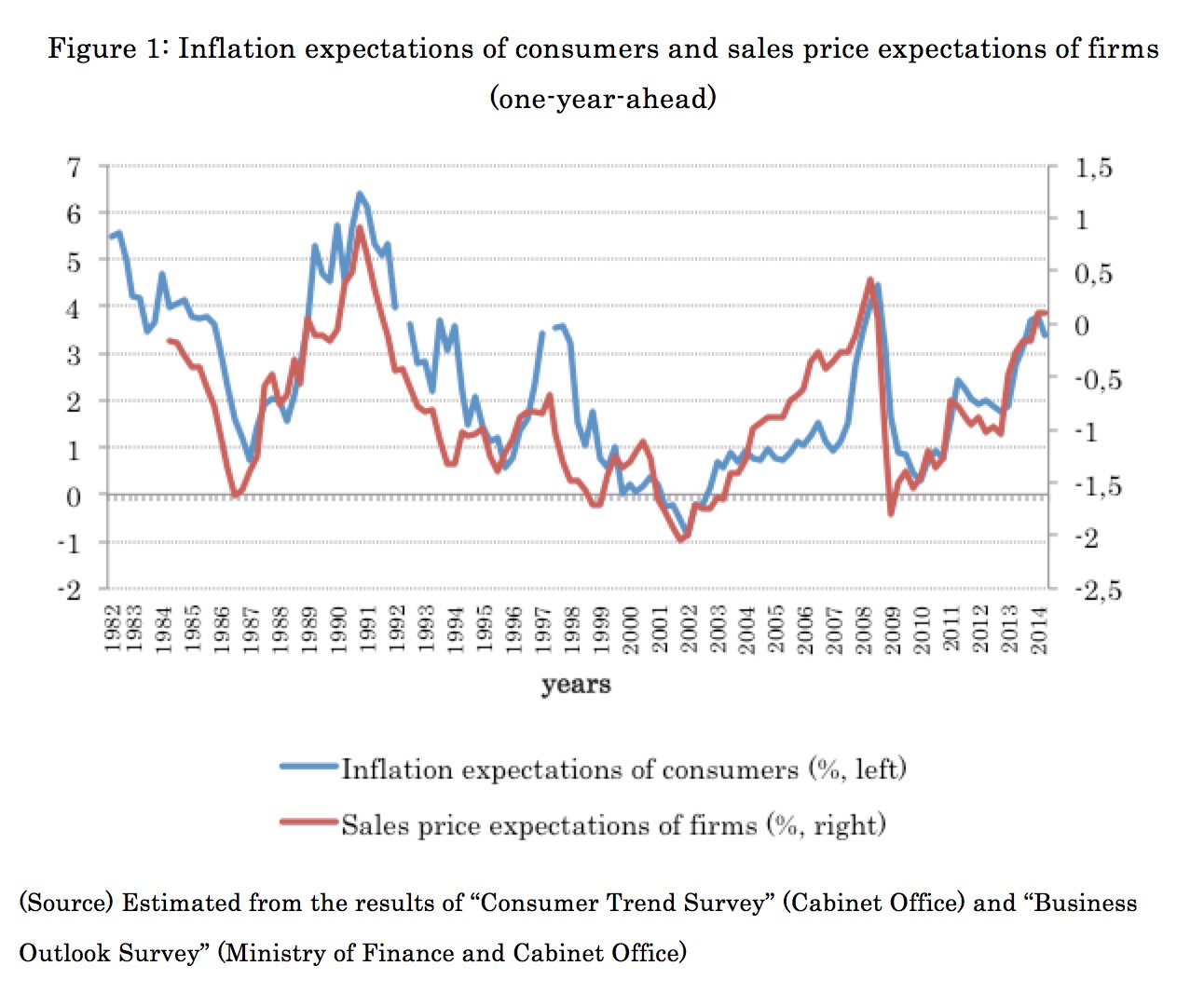

Policymakers have been discussing the importance of inflation expectations now that the Japanese economy is about to exit a long-lasting deflationary period. Despite its theoretical importance, measuring inflation expectations in a precise manner is not an easy task as inflation expectation is subjective and varies significantly among agents. In Japan, policymakers have been inquiring with both consumers and firms about their expectations through surveys. Figure 1 shows the trends of the one-year-ahead inflation expectations of consumers and firms for the FY1982–2013 period. On average, it is evident that both expectations move together; only occasionally, consumers’ expectations lag slightly behind firms’ expectations, particularly during the period leading up to the global financial crisis.

Although they move in a closely correlated manner, there is a consistent gap between the levels of the two expectations throughout the period. The average inflation expectations of consumers are higher than the consumer price index (CPI), while the average inflation expectations of firms (of their sales prices in particular) can be lower than the CPI.

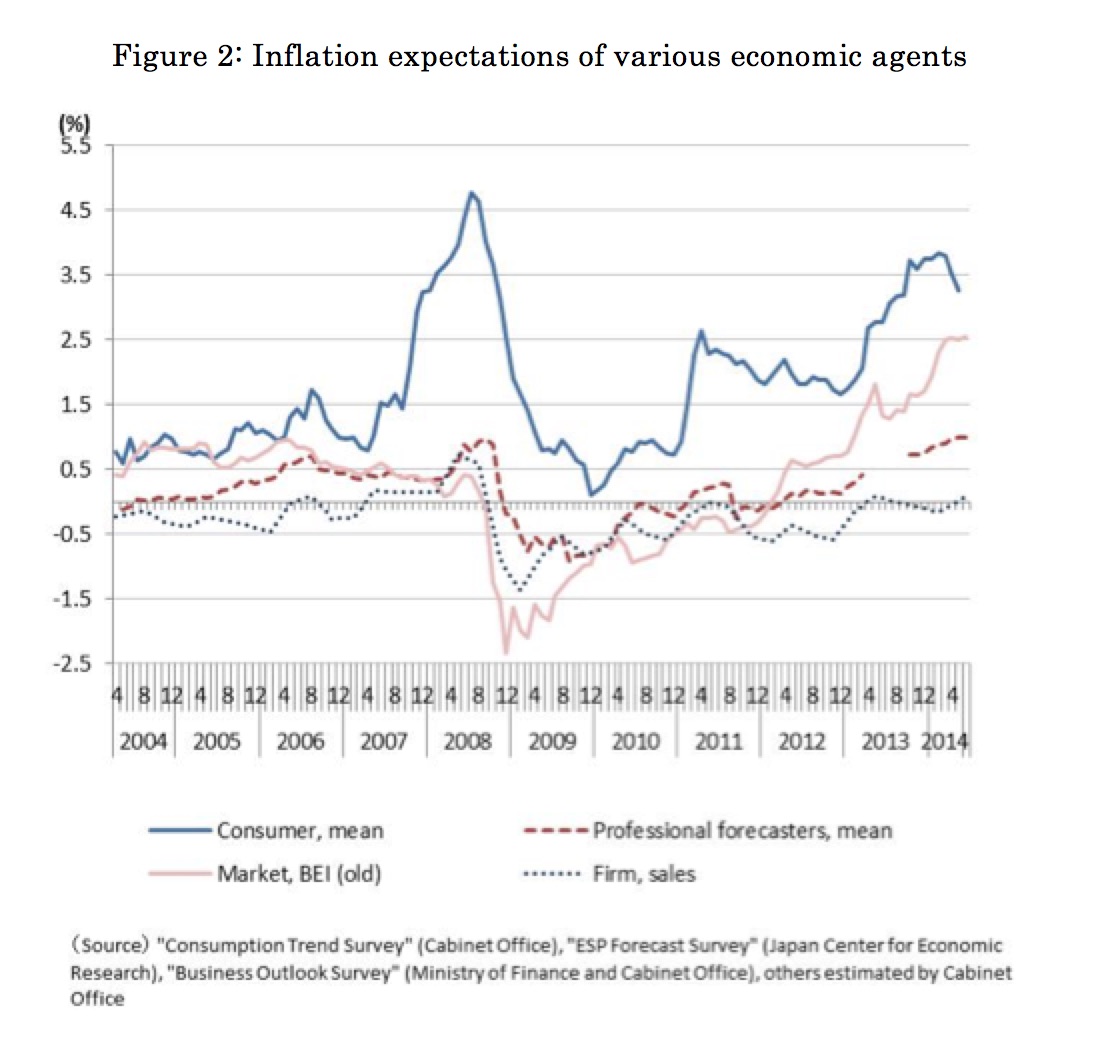

The formation process of inflation expectations has been examined in previous literatures but is yet to achieve consensus. In fact, Figure 2 shows that inflation expectations of consumers, firms, markets, and private forecasters move similarly while their levels differ. Figures 1 and 2 indicate that at the macro level, economic agents might be using similar information sets, while micro-level survey results imply that expectations indeed vary to a significant extent among agents. One of the major questions for economists is why expectations are so heterogeneous even when the inflation relevant for each agent should not be much different.

Experimental study of consumers’ inflation expectations

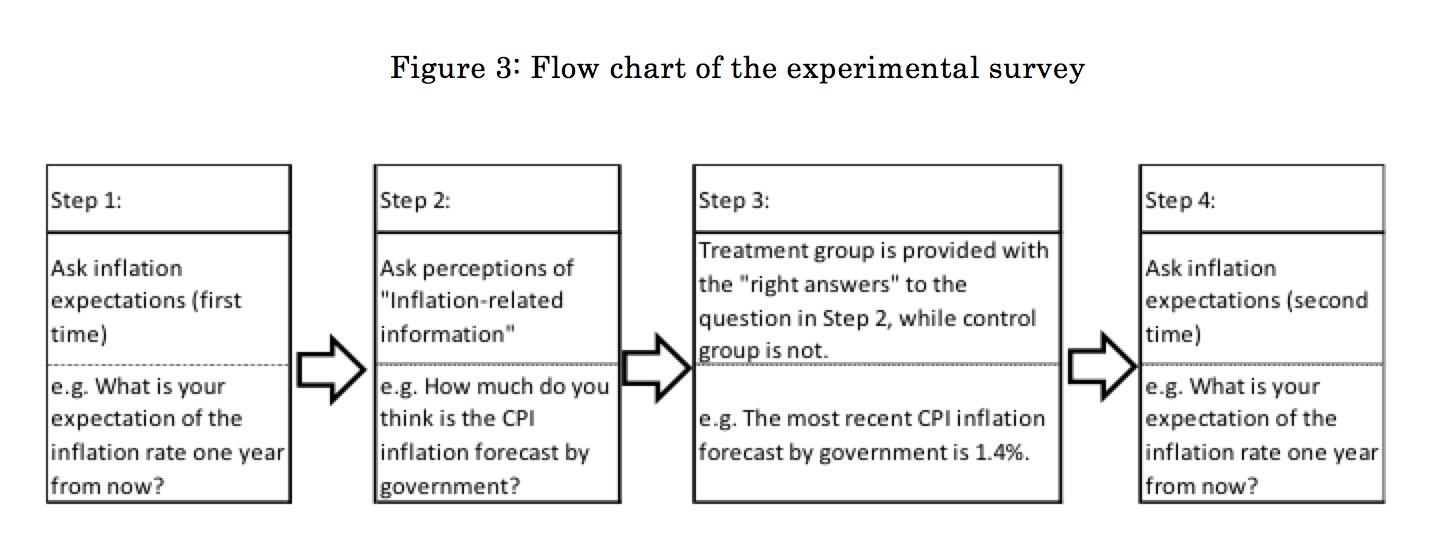

To address this question, we conduct an experimental study to investigate the formation process of consumers’ inflation expectations. More specifically, we compare consumers’ inflation expectations before and after we provide them with certain information within an experimental condition. If consumers considered the provided information to be relevant to the future inflation development, they would reflect the information by revising their expectations (i.e., the so-called “learning process”). The main aim of this study is to measure the extent of this learning by providing consumers with certain publicly available data related to future price trends.

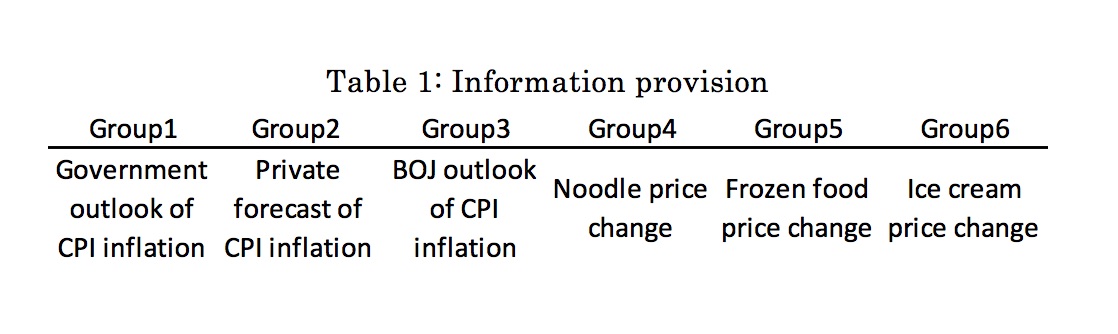

The survey was conducted in January 2015, when several food manufacturers announced the upcoming price hike of some of their major products in succession because of the rise in energy prices as well as the weakening currency. Figure 3 shows a flow chart of our experimental survey. We assigned our respondents to one of the six information groups and provided inflation-related information as shown in Table 1. The information provided to Groups 4 to 6 is based on the announcement made by private companies regarding the upcoming price hike of their products.

In each information Group, we further divide the respondents to those who are informed of the right answers to step 2 (treatment group) and those who are not (control group).

Step 2 intends to measure the respondents’ knowledge level of the prospect for future inflation. As the gap between the response and the right answer (henceforth “perception gap”) becomes narrower, we consider the respondent better informed about future inflation. In this study, we assume a negative relationship between this gap and the extent of revision in inflation expectations from step 1 to step 4, which implies that less-informed consumers learn to a greater extent how to modify “errors” in correspondence with perception gaps. Naturally, the scope of learning should be dependent on whether consumers identify the provided information as relevant to future inflation. Thus, we provide different kinds of information to compare the extent of learning among randomly assigned consumers. Given perception gaps, the extent of the expectations revision is assumed to reflect how much faith respondents have in the provided information as a signal of future inflation.

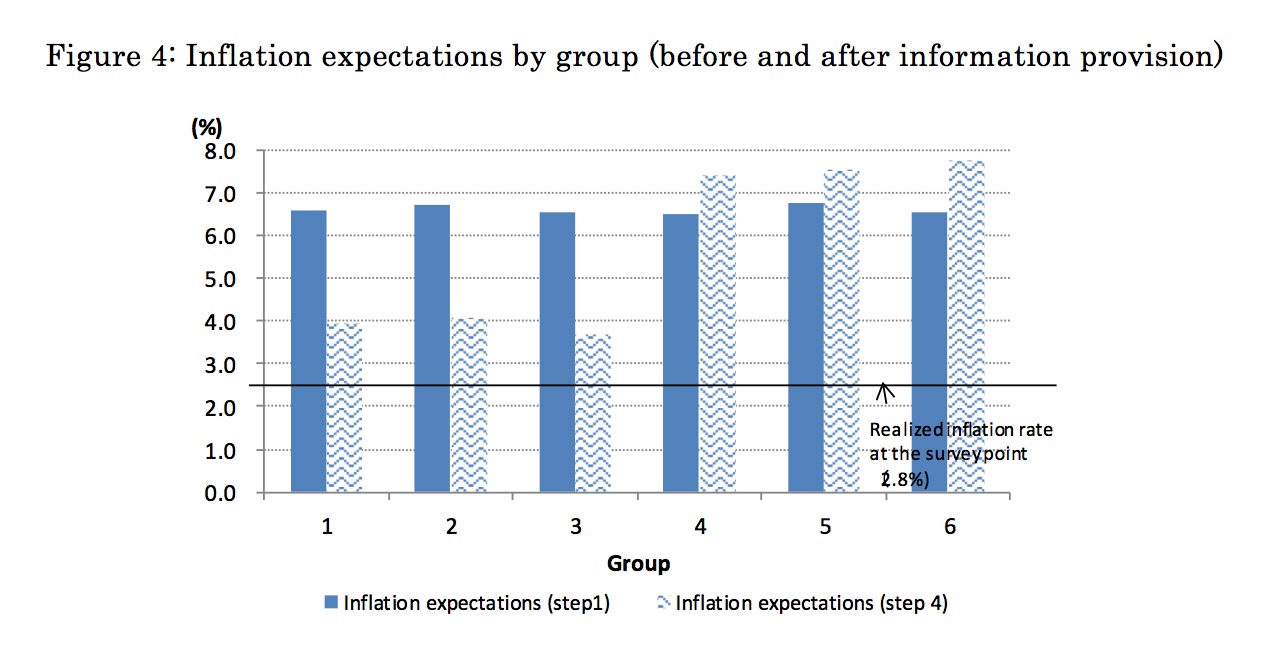

Consumers’ expectations tend to be high and heterogeneous

Figure 4 compares the average inflation expectations among groups before and after information provision. Before the information provision, inflation expectations were around 6–7% on average, much higher than the realized inflation rate (2.8% year-on-year changes). After the information provision, expectations declined by 3% points in Groups 1–3, while they increased by 1% point in Groups 4–6. In total, around 70% of the respondents updated their expectations, which indicates that people are quite responsive to new information in the formation of their expectations.

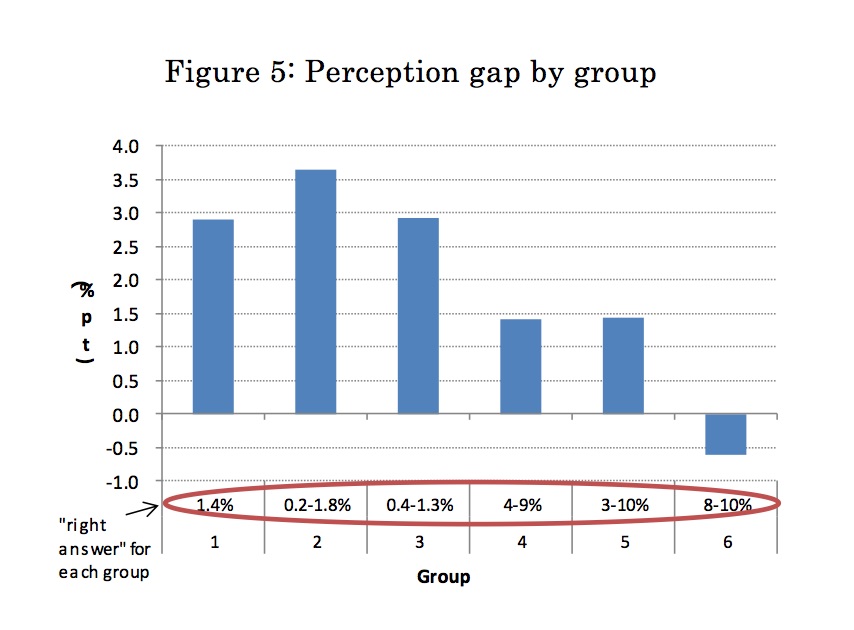

Figure 5 shows the average perception gap [i.e., (perception)-(right answer)] by group. In most groups, the gap is positive; people tend to overestimate inflation-related information. This is consistent with the findings on inflation expectations, as shown in Figure 4. We expect that a positive (negative) perception gap is linked to a downward (upward) revision of inflation expectations, which is not necessarily the case with Groups 4 and 5.

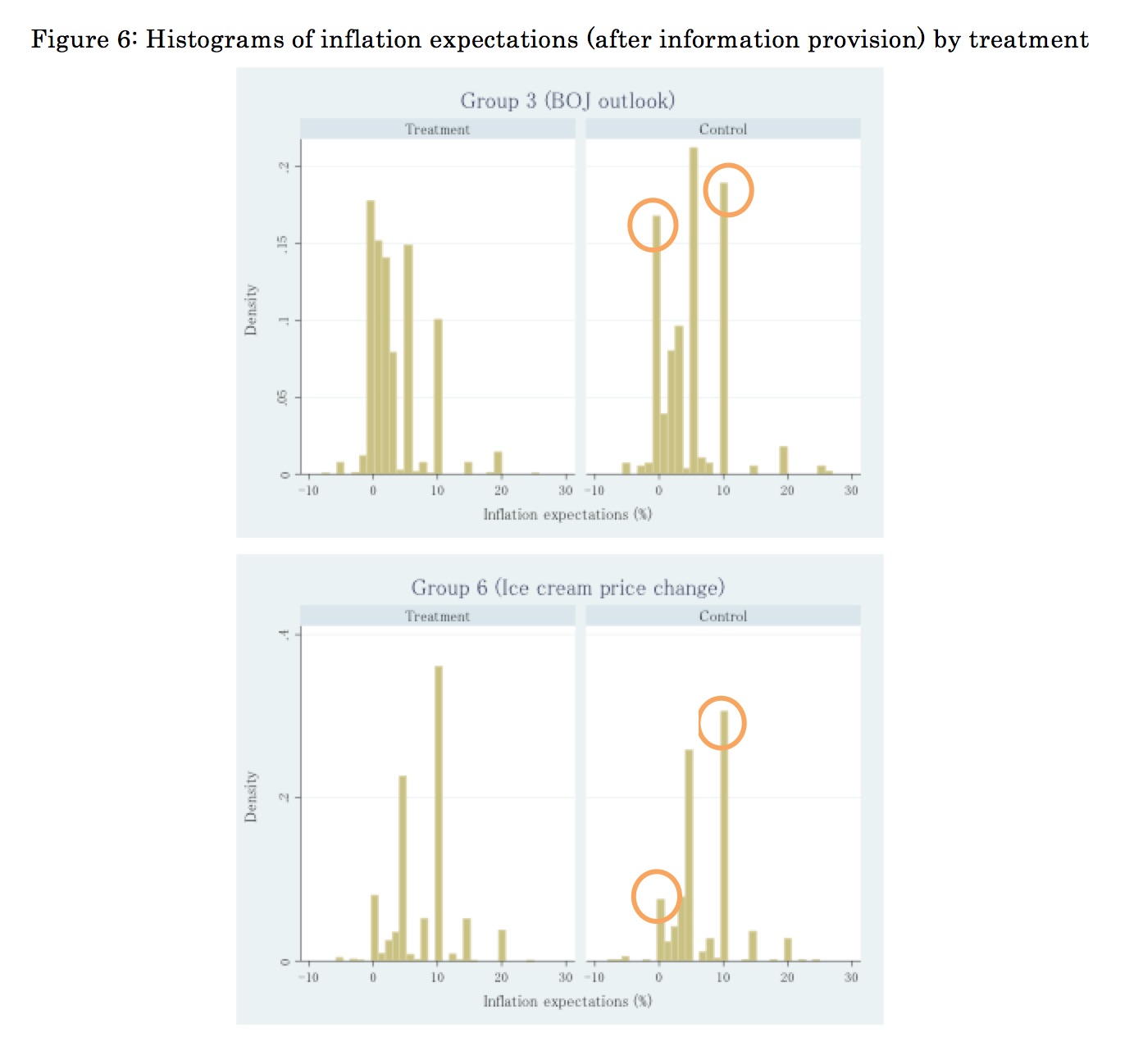

The histograms of expectations after the information provision evidently take different shapes between treatment and control groups (Figure 6). For example, in Group 3, respondents who are informed that the BOJ outlook for the CPI inflation is 0.2–1.8% are more likely to lower their inflation expectations in step 4 to around 0–5%. In contrast, those who do not get any information are likely to expect the inflation rates to be either 5% or 10%, without changing their primary expectations considerably. In Group 6, respondents are informed that the price of ice-cream is about to be raised by 8–10%. In this case, they are most likely to expect the inflation to be 10% (or 5%). The histograms of treatment and control groups for this group look similar because expectations already concentrate on 5% and 10% points before the information provision. Interestingly, the shapes of the histograms of control groups look different when Group 3 and 6 are compared, although neither is provided with specific inflation figures; for example, the density of those with “0%” expectations is relatively high in Group 3, while that of those with “10%” expectations is relatively high in Group 6. This implies that people’s expectations are responsive not only to specific figures but also to mere keywords such as “Bank of Japan” or “rise in ice-cream prices.” It might be that these keywords remind respondents of what they have heard in the media and lead them to change their expectations.

Although the majority of respondents update their expectations in step 4, around 20% of the treatment and 30% of the control groups in Groups 1 to 3, as well as 30% of the treatment and 40% of the control groups in Groups 4 to 6 do not change expectations. For these people, the provided information (or keywords) is already known or is considered irrelevant for future inflation.

Learning process is important

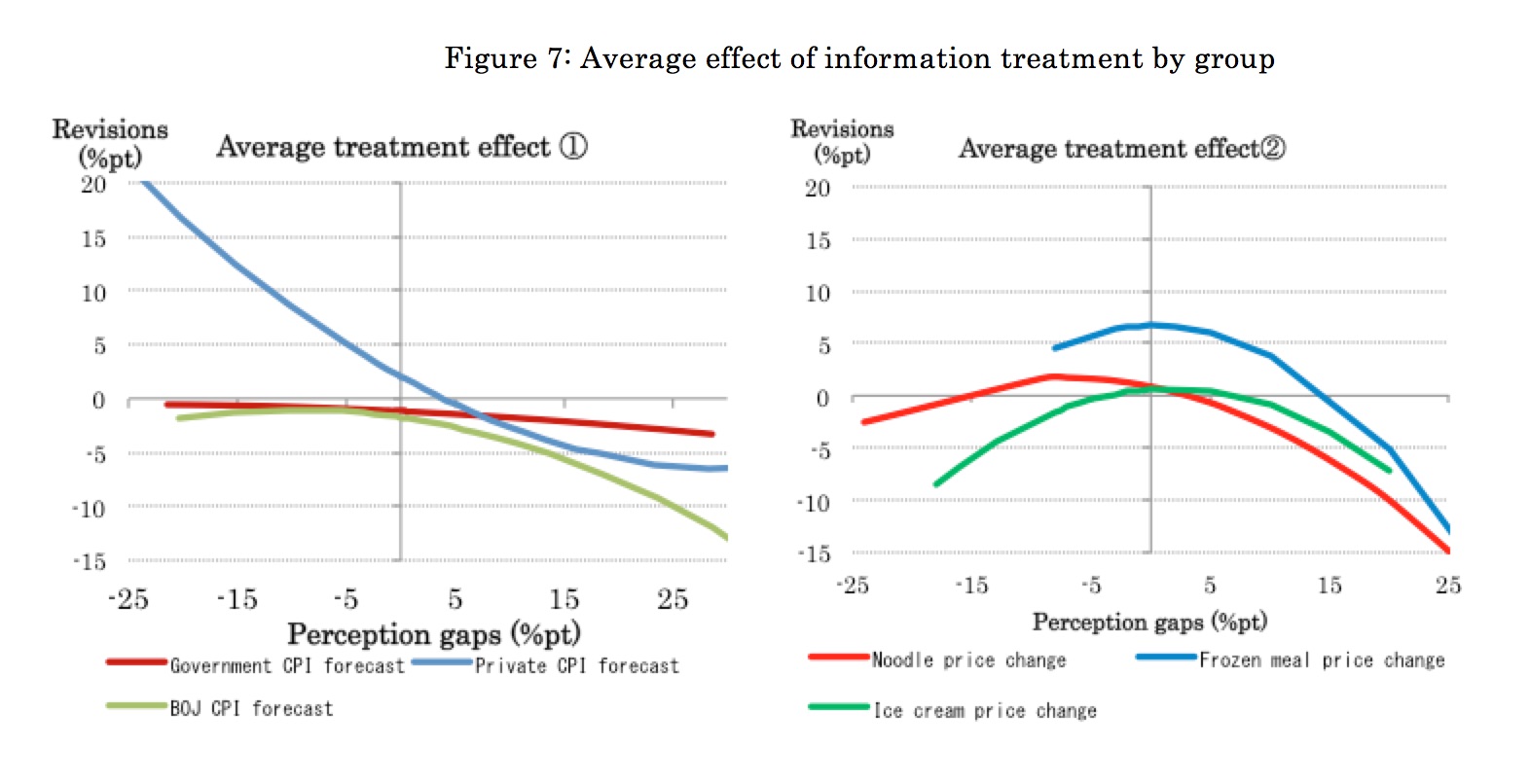

Finally, we estimate a simple model to examine the relationships between perception gaps and the extent of expectation revisions (i.e., learning). For this estimation, we assume that these relationships vary among groups, and that a certain percentage of people do not change their expectations because of insufficient signal strength from the received information.

Figure 7 describes the estimated information treatment effect conditional on perception gaps. As expected, negative relationships between perception gaps and revisions seem to exist particularly when perception gaps are positive. In other words, if respondents over-predict the inflation-related information, they lower the expectation to a greater extent after receiving new information. The estimated steepness of the slopes is different among information types; it is relatively steep for Groups 3 (BOJ), 4 (noodle price) and 5 (frozen meal), while rather flat for Group 1 (Government). When perception gaps are negative (i.e., under-prediction), negative relationship is only evident for Group 2 (private forecaster).

Conclusion: consumers are likely to be influenced by the BOJ information

To conclude, the results indicate that people’s expectations are quite likely to be influenced by new information, while the extent of this influence differs depending on the type of information. Consumers tend to be influenced not only by the information coming from financial authorities (BOJ) but also by the information about the expected price increase of typical groceries. As we have seen in the literature, consumers decide their own expectations based on their recent shopping experience, while their memories are in fact rather uncertain and do not reflect the real inflation they have experienced. Unlike professional forecasters, consumers may form expectations spontaneously and are normally not so aggressive in collecting relevant information on their own, while on the other hand, they often learn from new information if it is readily available.

Yuko Ueno is Associate Professor at the Economic Research Institute, Hitotsubashi University. She has been working as economist at the Economic and Social Research Institute, Cabinet Office, Government of Japan (July 2003 – June 2005), at the Directorate for Science, Technology and Innovation, OECD (July 2007 – January 2011) and as Chief statistician at the Economic and Social Research Institute, Cabinet Office, Government of Japan (August 2011-August 2013). Her research fields includ Labor Economics and Monetary Economics.

Professor Ueno is Visiting Researcher at the Center for French-Japanese Advanced Studies in Paris from September 2015 to November 2015.

|

|

Recherche |  |

FFJ Research Statement |  |

Yuko UENO |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".