Sota KATOThe following is a condensed and non technical version of the paper

“Valley of Institutional Change: Japanese Political Economy 1990-2005” (http://www.tokyofoundation.org/en/images/SASE2012_institutionalchange.pdf)

|

|

Puzzle

Why does an extensive reform of a national political-economic system invite temporary, and often substantial, loss of economic output? This question was initially raised in relation to the transition between capitalism and socialism/communism. Adam Przeworski, an eminent political economist, pointed out that, even if assuming that socialism is superior to capitalism, there is a “valley of transition” or temporary decline in workers’ welfare during the transition from capitalism to socialism (Capitalism and Social Democracy, 1985). According to Przeworski, such a “valley of transition” acts as one of the obstacles in a transition from capitalism to socialism. The topic became a highly debated issue when the opposite transition, from communism to capitalism, occurred after the fall of the Berlin Wall. The question was especially puzzling because when ex-communist states initiated their transition toward capitalism in the early 1990s, the consensus among scholars and reformers was that the capitalist system was superior to the communist system in producing better economic outcomes. Reformers at that time thus rushed to implant the Western capitalist system in post-communist states but the results were mostly devastating, as Gérard Roland noted (Transition and Economics: Politics, Markets, and Firms, 2000). Transitional economists’ analyses as well as Przeworski’s earlier analysis on this topic were, however, dependent on peculiarity of socialism and/or communism. The range of applicability of their analyses was thus often limited to transitions between capitalism and socialism and/or communism.

After the fall of Berlin Wall, social scientists including a group of political scientists who initiated the study of “Varieties of Capitalism (VOC)” (Varieties of Capitalism: The Institutional Foundations of Comparative Advantage, eds. Peter A. Hall and David Soskice, 2001) came to realize that there were divergent patterns in the political-economic system within capitalism. When neoliberal reforms swept across the world in the 1990s, many wondered whether the different patterns of capitalism would converge to the so-called “Anglo-Saxon Model”. In stark contrast to the rich accumulation of research on transitional economies, however, few have attempted to analyze the consequences of transitions from one type of capitalism to another.

In a paper, “Valley of Institutional Change: Japanese Political Economy 1990-2005,” I tackled the question raised at the outset from two new aspects. First, the theoretical model of the paper does not, in contrast to existing literature on this topic, rely on the peculiarity of capitalism or socialism or communism. Instead, the model bases itself on theories of institution and institutional change that are rapidly developing in social science. Secondly, by empirically examining the case of Japan from 1990 to 2005, the paper analyzed the effect of transition between different types of capitalism.

Argument

Why does an extensive reform of a national political-economic system invite temporary, and often substantial, loss of economic output? This question was initially raised in relation to the transition between capitalism and socialism/communism. Adam Przeworski, an eminent political economist, pointed out that, even if assuming that socialism is superior to capitalism, there is a “valley of transition” or temporary decline in workers’ welfare during the transition from capitalism to socialism (Capitalism and Social Democracy, 1985). According to Przeworski, such a “valley of transition” acts as one of the obstacles in a transition from capitalism to socialism. The topic became a highly debated issue when the opposite transition, from communism to capitalism, occurred after the fall of the Berlin Wall. The question was especially puzzling because when ex-communist states initiated their transition toward capitalism in the early 1990s, the consensus among scholars and reformers was that the capitalist system was superior to the communist system in producing better economic outcomes. Reformers at that time thus rushed to implant the Western capitalist system in post-communist states but the results were mostly devastating, as Gérard Roland noted (Transition and Economics: Politics, Markets, and Firms, 2000). Transitional economists’ analyses as well as Przeworski’s earlier analysis on this topic were, however, dependent on peculiarity of socialism and/or communism. The range of applicability of their analyses was thus often limited to transitions between capitalism and socialism and/or communism.

After the fall of Berlin Wall, social scientists including a group of political scientists who initiated the study of “Varieties of Capitalism (VOC)” (Varieties of Capitalism: The Institutional Foundations of Comparative Advantage, eds. Peter A. Hall and David Soskice, 2001) came to realize that there were divergent patterns in the political-economic system within capitalism. When neoliberal reforms swept across the world in the 1990s, many wondered whether the different patterns of capitalism would converge to the so-called “Anglo-Saxon Model”. In stark contrast to the rich accumulation of research on transitional economies, however, few have attempted to analyze the consequences of transitions from one type of capitalism to another.

In a paper, “Valley of Institutional Change: Japanese Political Economy 1990-2005,” I tackled the question raised at the outset from two new aspects. First, the theoretical model of the paper does not, in contrast to existing literature on this topic, rely on the peculiarity of capitalism or socialism or communism. Instead, the model bases itself on theories of institution and institutional change that are rapidly developing in social science. Secondly, by empirically examining the case of Japan from 1990 to 2005, the paper analyzed the effect of transition between different types of capitalism.

Argument

I argue that an extensive institutional change of a political-economic system inevitably invites a temporary output fall which we call a “valley of institutional change”. The argument is theoretically derived from two premises: (1) institutional complementarities exist among institutions that compose a political-economic system and (2) different types of institutions change at different speeds. Both of the premises are generally accepted by social scientists who study institution and institutional change. A set of institutions is said to be complementary to another when its presence raises returns available from the other (“Varieties of Capitalism and Institutional Complementarities in the Political Economy: An Empirical Analysis” by Peter A. Hall and Daniel W. Gingerich, British Journal of Political Science, 39, 2009). The idea of institutional complementarities has been widely accepted by social scientists across disciplines. As for the second premise, Oliver E. Williamson distinguished four levels of institutions by how quickly they change (The Mechanism of Governance, 1996). Gerald Roland classified institutions into “slow-moving” and “fast-moving” (“Understanding Institutional Change: Fast-Moving and Slow-Moving Institutions” in Studies in Comparative International Development, Winter 2004), while I have shown that “government centered institutions” – institutions such as legal systems that the government deliberately establishes – change faster than “private centered institutions” such as business customs (“Bifurcated Process of Institutional Change: An Empirical Investigation” in Mimeo, 2012). Under these two premises, the logic behind our argument is as follows. When a national political-economic system composed of mutually complementary institutions undergoes an extensive reform, different types of institutions, by their nature, change at different speeds. Such a gap in the speed of institutional change invites loss or loosening of institutional complementarities. This loss or loosening of institutional complementarities leads to loss of economic output. In this paper I construct a formal model and prove that there is a “valley of institutional change” – a temporary output fall during an extensive institutional change – under certain conditions.

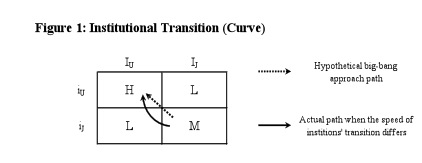

Chart 1 shows an illustrative example of the argument. Suppose that in Country U, Institution IU and Institution iU are complementary. Also suppose that in Country J, Institution IJ and Institution iJ are complementary. The combination of IU and iU generates H (high) economic performance in Country U, the combination of IJ and iJ generates M (mediocre) economic performance in Country J, and the combination of institutions without complementarities ({IU, iJ},{IJ, iU}) generates L (low) economic performance.

Policymakers and the public in Country J, after observing that the economic performance of Country U outperforms their country’s performance, may seek a systemic transformation to the institutions of Country U. That was what exactly happened in Japan in the 1990s when the growth rate of the US economy constantly outpaced that of Japan. As for the transformation strategy, policymaker would probably want to transform Institution I and Institution I simultaneously because if Institution I and Institution I are transformed separately, they would temporarily experience a low-performance combination of {IU, iJ} that results in performance lower than the current performance of Country J. Thus, policymakers of Country J would want to jump to the system of Country U through the “big bang” approach, changing Institutions I and Institution I simultaneously.

Suppose, however, that the speed of transformation for Institution I is faster than the speed of transformation for Institution i. In that event, even when policymakers intend to make a linear jump from the system of Country J to the system of Country U, the actual transformation path would curve as shown in Chart 3, and temporarily go through the domains of IU and iJ, resulting in the decline of the economic performance of Country J. This is an intuitive description of the “valley of institutional change” I mentioned.

Chart 1 shows an illustrative example of the argument. Suppose that in Country U, Institution IU and Institution iU are complementary. Also suppose that in Country J, Institution IJ and Institution iJ are complementary. The combination of IU and iU generates H (high) economic performance in Country U, the combination of IJ and iJ generates M (mediocre) economic performance in Country J, and the combination of institutions without complementarities ({IU, iJ},{IJ, iU}) generates L (low) economic performance.

Policymakers and the public in Country J, after observing that the economic performance of Country U outperforms their country’s performance, may seek a systemic transformation to the institutions of Country U. That was what exactly happened in Japan in the 1990s when the growth rate of the US economy constantly outpaced that of Japan. As for the transformation strategy, policymaker would probably want to transform Institution I and Institution I simultaneously because if Institution I and Institution I are transformed separately, they would temporarily experience a low-performance combination of {IU, iJ} that results in performance lower than the current performance of Country J. Thus, policymakers of Country J would want to jump to the system of Country U through the “big bang” approach, changing Institutions I and Institution I simultaneously.

Suppose, however, that the speed of transformation for Institution I is faster than the speed of transformation for Institution i. In that event, even when policymakers intend to make a linear jump from the system of Country J to the system of Country U, the actual transformation path would curve as shown in Chart 3, and temporarily go through the domains of IU and iJ, resulting in the decline of the economic performance of Country J. This is an intuitive description of the “valley of institutional change” I mentioned.

Empirics

Hypotheses derived from the theoretical model were tested against panel data of Japanese industries (n=65) from 1990 to 2005. During this period, Japan underwent extensive neoliberal reforms, abandoning the once renowned “Japan model” and aiming “to be more like the United States”.

The “Japan model” was characterized by intimate, long-term, and informal government-industry and finance-industry relationships (Nihon no Keizai System [Japanese Economic System], Juro Teranishi, 2003). Both relationships were, as several other researchers have pointed out, mutually complementary. The main testing variables for industry-level analysis in this paper are thus composed of those that represent institutions for government-industry coordination (Git) and finance-industry coordination (Fit). I constructed indices that represent each of them for empirical testing. The summary of each index is shown in Table 1.

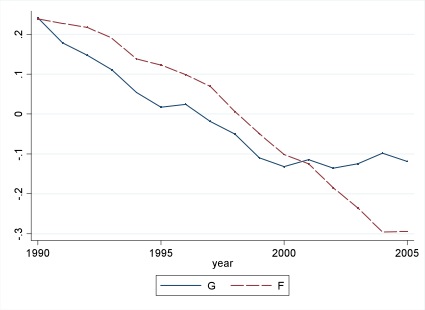

Chart 2 shows how Git and Fit, each aggregated across industries, changed from 1990 to 2005. Both lessened their values substantially during the period, meaning that the “Japan Model” was considerably dismantled. Between the two, Git changed faster when extensive institutional change started in the early 1990s. Fit eventually took over Git when Git completed institutional change. This is in line with my earlier claim that “government centered institutions” change faster than “private centered institutions”.

One can intuitively grasp from Chart 2 that the gap in the speed of institutional change between Git and Fit loosened institutional complementarities between the two during the period. In the statistical analysis, I assessed how such loosening of institutional complementarities during the period affected the economic outputs of industries.

The main testing variable (ICit ) for the statistical test was an indicator that estimates how institutional complementarities between the finance-government relationship (Fit) and the government-industry relationship (Git) have loosened since 1990. The dependent variable of the empirical testing was the output of each industry. The results of statistical tests including several tests to check robustness showed that the coefficient of the testing variable ICit is substantially and significantly negative. That is, loss of institutional complementarities between Git and Fit lead to substantial and significant output loss. The parameter estimates were mostly stable across all the models and signs of the coefficients of other control variables that took statistically significant values were as expected.

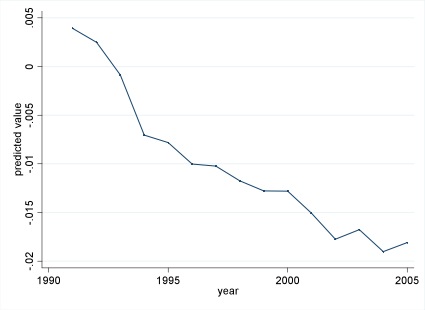

Chart 3 shows the result of simulations that estimated output loss caused by loss of institutional complementarities during extensive institutional change that took place in Japan after 1990. As is clear, an extensive institutional change and loss of institutional complementarities invite a serious output fall, which I call a “valley of institutional change”.

The “Japan model” was characterized by intimate, long-term, and informal government-industry and finance-industry relationships (Nihon no Keizai System [Japanese Economic System], Juro Teranishi, 2003). Both relationships were, as several other researchers have pointed out, mutually complementary. The main testing variables for industry-level analysis in this paper are thus composed of those that represent institutions for government-industry coordination (Git) and finance-industry coordination (Fit). I constructed indices that represent each of them for empirical testing. The summary of each index is shown in Table 1.

Chart 2 shows how Git and Fit, each aggregated across industries, changed from 1990 to 2005. Both lessened their values substantially during the period, meaning that the “Japan Model” was considerably dismantled. Between the two, Git changed faster when extensive institutional change started in the early 1990s. Fit eventually took over Git when Git completed institutional change. This is in line with my earlier claim that “government centered institutions” change faster than “private centered institutions”.

One can intuitively grasp from Chart 2 that the gap in the speed of institutional change between Git and Fit loosened institutional complementarities between the two during the period. In the statistical analysis, I assessed how such loosening of institutional complementarities during the period affected the economic outputs of industries.

The main testing variable (ICit ) for the statistical test was an indicator that estimates how institutional complementarities between the finance-government relationship (Fit) and the government-industry relationship (Git) have loosened since 1990. The dependent variable of the empirical testing was the output of each industry. The results of statistical tests including several tests to check robustness showed that the coefficient of the testing variable ICit is substantially and significantly negative. That is, loss of institutional complementarities between Git and Fit lead to substantial and significant output loss. The parameter estimates were mostly stable across all the models and signs of the coefficients of other control variables that took statistically significant values were as expected.

Chart 3 shows the result of simulations that estimated output loss caused by loss of institutional complementarities during extensive institutional change that took place in Japan after 1990. As is clear, an extensive institutional change and loss of institutional complementarities invite a serious output fall, which I call a “valley of institutional change”.

Discussion

This analysis of the “valley of institutional change” has strong implications for the current global situation where, as VOC pointed out, different patterns of capitalism coexist. VOC has been criticized for being excessively static. Why do different patterns of capitalism not change one way or another? Why does the world not converge on a single model? These questions are analogous to the one that Przeworski faced in the mid-1980s between capitalism and socialism. Indeed, the Japanese case since the 1990s was an attempt to change the Japanese political-economic system to the Anglo-Saxon model. The existence of a “valley of institutional change”, however, can at least partially explain why different types of capitalism remain divergent and do not converge. That is, “valley of institutional change” might intimidate policymakers, business, and the public to radically transform their national political economic system. In such a context, the analysis in this paper legitimizes, to a certain extent, the static nature of VOC.

This research also adds a new perspective to Japan’s so-called “lost decade” debate. Japanese policymakers were often criticized for acting “too little, too late” but this paper’s analyses suggest that what was crucial for Japanese policymakers was not just to accelerate the pace of change but to maintain a balanced pace of change among different spheres of the political-economic system.

The results of these analyses pose a tough challenge for the leaders of capitalist states. The existence of a “valley of institutional change” indicates that firms and voters are reluctant to accept major changes. Leaders who can persuade firms and voters to endure a severe output fall in the short run and can also coordinate the paces of institutional change among the different political-economic spheres will be capable of initiating and sustaining extensive change.

This research also adds a new perspective to Japan’s so-called “lost decade” debate. Japanese policymakers were often criticized for acting “too little, too late” but this paper’s analyses suggest that what was crucial for Japanese policymakers was not just to accelerate the pace of change but to maintain a balanced pace of change among different spheres of the political-economic system.

The results of these analyses pose a tough challenge for the leaders of capitalist states. The existence of a “valley of institutional change” indicates that firms and voters are reluctant to accept major changes. Leaders who can persuade firms and voters to endure a severe output fall in the short run and can also coordinate the paces of institutional change among the different political-economic spheres will be capable of initiating and sustaining extensive change.

TABLE 1 Coordination Indices

|

Index

|

|

|

Variables

|

|

|

|

|

Keiretsu ratio (ratio of firms affiliated in major keiretsu)

|

|

|

|

Private debt to equity ratio

|

|

|

|

|

Cross-shareholding ratio (ratio of mutually held shares by two firms)

|

|

|

|

|

Non-capital market finance ratio

|

|

|

|

|

|

Number of ex-bureaucrats (amakudari bureaucrats)

|

|

|

|

Amount of political donations

|

|

|

|

|

Budget size of trade association

|

|

|

|

|

Ratio of firms under government regulation

|

CHART 2 Transition of coordination indices

CHART 3 Predicted output fall caused by loss of institutional complementarities during extensive institutional change (simulation)

| Sota Kato est professeur à l' International University of Japan et senior fellow à la Tokyo Foundation. Après avoir obtenu un diplôme de droit à l'université de Tokyo, il est entré au MITI en 1991 au sein duquel il a occupé différentes positions pour diverses industries: assistant directeur dans l'industrie de la défense navale, député directeur de la division économique internationale du MITI, et chercheur associé à l'Institut de Recherche d'Economie, Commerce et Industrie. Il a également obtenu un Master de l'université Harvard Business School, puis un doctorat en sciences politiques à l'université du Michigan. Sato Kato est le lauréat du 1er prix décerné par la Fondation France Japon dans le cadre du network Q de la 24ème conférence internationale SASE 2012, récompensant le meilleur article sur les capitalismes asiatiques pour son article intitulé: “Valley of Institutional Change: Japanese Political Economy 1990-2005” |