Jun SUZUKITwo faces of patent value

How can we evaluate the patent value and what affects it?

There is an ever-increasing concern for innovation also in Japan. Is Japan losing a part of its innovation capacity? Actually, some leading companies such as Sony and Panasonic are facing increasing difficulties. Manufacturing in Japan as a percent of GDP has been in steady decline in these decades. The number of patents applied in Japan passed a peak in 2005 and is continuously decreasing afterward while emerging competitors are showing rapid growth. We must understand how things really are and speculate what we can do for innovation. However, counting patents is too naïve. In this essay, I would like to shed light on the structure of patent value and think about the factors affecting that.

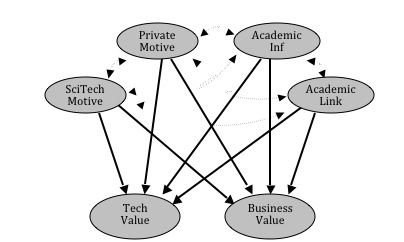

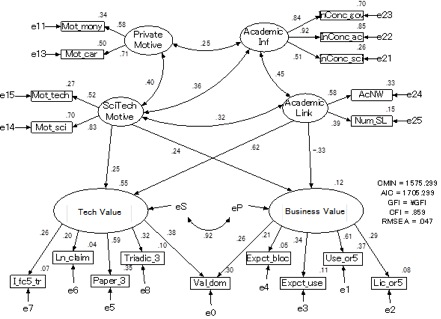

1. Patent data in innovation studies For recent years, many researchers have used quantitative and qualitative analysis of patent data for studying innovative activities. A globally uniform format and technological classification have allowed diverse analytical approaches to emerge, and have played an important role in the development of empirical studies of innovation. However, due to the highly skewed distribution of patent value; namely, that with the exception of a very small number of patents, patent data which use an aggregate total number do not contain much information. For example, in a comprehensive review written in 1990, Griliches could find practically no correlation between a simple count of patents and the valuation of a company on the stock market, stating that “the needle might be there, but the haystack is very large” (Griliches, 1990). Theoretically, the number of patents that are being held by firm can be thought of as an indicator for the successful outcomes from research and development and reflects in the market value of the firm. However, significant “noise” makes it difficult to obtain useful information from simple patent counts. To tackle with this issue, researchers began to focus on finding indicators of individual patent value for weighting the number of patents, and to clarify the usefulness of patent indicator as a proxy for innovation.  “The needle might be there, but the haystack is very large” 2. Structural modeling of the value of patent (Suzuki, 2011) In the course of patent value research, it has been well recognized that “patent value” has mainly two faces. The first face is seen as the basis of the value of technological knowledge, or “technological value”. The second, those patents that are used (for new products, processes or licensed) or strategically possessed (for blocking other firms’ technologies) have “business value” or “private value”. Until now, most of the empirical research has concentrated on the latter as it is more interesting from the management point of view. However, the former one might be more important from the long-term innovation viewpoint and inventor’s motive. I have analyzed the components of patent value applying structural equation modeling (SEM) with the data from 2007 Survey of Inventors performed by Research Institute of Economy, Trade and Industry (RIETI) in Japan. For an outline of the survey, see Nagaoka and Tsukuda (2007) which asked specific questions regarding the value of patents to inventors among many other questions. SEM is a technique which is developed as an expansion of factor analysis. It can handle latent factors as well as observed variables, and has now become widely recognized and used in the fields of social and natural sciences. Latent factors that are not directly observed but are rather inferred from other variables are useful to understand a framework concept. For example, I will use the latent variable named “Private Motive” which is calculated from the weighted values of observed variables of “motive for monetary reward” and “motive for advancement”. SEM allows for the modeling of the causal relationship between the observed and latent variables, whereby the factors that influence patent value can be investigated.  Initial theoretical model of correlation and causal relationship for patent value with latent factors (double-headed arrows describe correlations and single-headed arrows describe causal relationships)  SEM results for the structural model of patent value I have obtained a fairly good structural model that explains observed variables including two latent factors; “technological value” and “business value” as the basis for a concept of patent values. This model, although a bit complicated, had a high goodness of fit indices and I believe it can provide us a novel viewpoint. Looking at the estimated results, inventors’ recognized value for patents (Val dom) is better explained by the technological value than the business value. This should be reflecting the situation where the inventor evaluates the “value of the patent” the technological value is considered slightly more seriously. According to this model, academic links has a strong positive influence on technological value, but in contrast, it has a negative influence on the business value. From the result of this analysis, it is suggested that SciTech Motive (inventor’s motivation for contributing to the progress of science and technology) has a direct positive effect on technological value as well as business value. Although there is a debate that researchers’ intellectual curiosity can be stimulated by a motivational incentive, it is possible to say that researchers who hold a high SciTech Motive create high value inventions. On the other hand, Private Motive of inventor such as financial or status does not have any significant direct effect on technological value or business value. Academic Inf (the ability for use of academic information by inventors) does not have a direct effect on technological value and business value. However, Academic Inf has strong relationships with two types of motives and Academic Link (the relationship with universities and public research institutes) which then affects to patent value.

3. Implications The implications suggested by this structural model are as follows: At first, the motivations for science and technology by researchers (contributing to the progress of science and technology and overcoming challenges and issues) are not only to raise the technological value of inventions; but also raising the business value of patent. This suggests that plans for human resources involved in corporate R&D should be nurtured and given consideration. For these individuals, how should motivation for science and technology be given through some sort of incentives?

The second implication from this structural model is concerning with the private motivation held by researchers (financial remuneration and the desire for promotion). For companies it is suggested that the direct elevation of the business value of patent through monetary incentive is difficult. However, the results of this analysis at the same time suggest that the personal motivation of researchers and science and technology motivations and information absorption, or “Absorptive Capacity” by Cohen and Levinthal (1990), have strongly positive relationships. Namely, a strong private motivation tends to accompany the strong technological motivation, and also accompanies the tendency for information absorption and its applicability. Whether or not the direction of these causal relations and necessary/sufficient condition is formed or not, requires further examination in the future. The third implication from this structural model is that the general influence of industry–university–government cooperation for the value of patents has two characteristics which are “plus” and “minus”. Namely, university-business cooperation operates in the direction in which the technological value of an invention rises, but, on the other hand it is suggested that value with respect to business is decreased. When viewed from the side of business perspective, a reason why patents from university–industry–government cooperative activities have only moderate value is that for rights (rights that are shared with universities on the basis of public funding) there are complications. For instance, for the business value of patents one component is the “blocking” potential; for corporate strategy a reason is that patent possession can be self -enforced and licensing not performed giving the patent value. However, on the university side, a general rule that require the optimum efforts to put patents into practice is sought; there are times when confrontation may emerge. Also, for universities and public research institutes, for the intellectual property rights from collaborative research performed through university–industry–government relations, the requests non-exclusive execution rights and for compensation for non-execution are often the cases. The desire on the industry side for easing from restrictions regarding the handling of research results is many. In addition, many inventions produced from university–industry cooperation are at a fundamental level, and direct connection with business is difficult and it is thought that value with respect to business is relatively low. Furthermore, the influence of industry–university–government cooperation differs largely depending upon the technical field (please see details in Suzuki, Jun, 2011). We are currently investigating this point or try to see if our results depend only on the Japanese context. In any case, we believe that this kind of research may help us to better understand the value of innovation. References Cohen, Wesley M., Levinthal, Daniel A., 1990. Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly 35 (1), 128–152. Griliches, Zvi, 1990. Patent statistics as economic indicators: a survey. Journal of Economic Literature 28 (December (4)), 1661–1707. Suzuki, Jun. 2011, Structural modeling of the value of patent, Research Policy 40, pp 986– 1000. Nagaoka, S., Tsukuda, N., 2007. Japan’s innovation process as viewed by inventors: outline results of RIETI inventors survey. RIETI Discussion Paper Series 07-J-046, 2007 |

|

Recherche |  |

FFJ Research Statement |  |

Jun SUZUKI |

| Inscrivez-vous à notre Lettre en cliquant ici |

*En cas de problème, vous pouvez aussi vous inscrire en envoyant un mail à sympa@ehess.fr, avec pour titre "subscribe ffj_french_news".